Due to the Covid-19 pandemic, the Ad Volumes on the Television witnessed a drop of 15% during Jan-Jun’20 over Jan-Jun’19, as per TAM AdEx’s half-yearly advertising report

The report further states that the ad volumes on TV rebounded in Jan-Jun’21, with strong growth of 21% over Jan-Jun’19, and a 43% upsurge over Jan-Jun’20.

In H1’20, TV Ad Volumes recovered with a sharp rise of 41% in Jun’20 over May’20. Jun’21 registered a drop of 8% over May’21. Despite a sharp increase in TV Ad Volumes during Jan-Jun ’21, the number of advertisers and brands remained lower than in the H1’19 period.

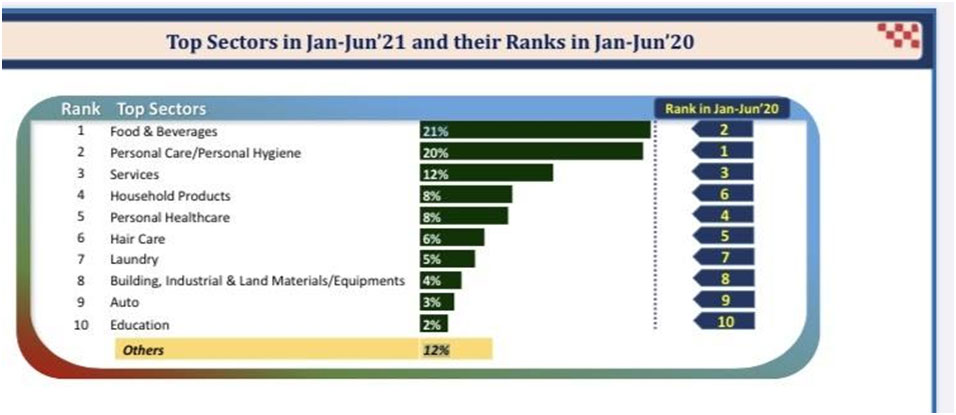

Food & Beverages among the sectors and Toilet Soaps among the categories topped in Jan-Jun’21 over Jan-Jun’20. Personal Care/Personal Hygiene with 20% share which was top in Jan-Jun’20 ranked second in Jan-Jun’21. The top 3 sectors together added 52% share of Ad volumes which were also among the Top 3 during Jan-Jun’20.

Toilet Soaps category maintained its 1st position during Jan-Jun’21 with 5% share of Ad Volumes. Toilet/Floor Cleaners moved up by 4 ranks to achieve 2nd rank replacing Ecom-Media/Ent./Social Media.

With a significant jump of 15 positions, ‘Ecom-Education’ enters the Top 10 categories. Ecom-Education and Aerated Soft Drink categories were the new entrants in the Top 10 categories’ list.

Jan-Jun’21 period witnessed 250+ growing categories. Toilet/Floor Cleaners among Categories saw the highest increase in Ad Volumes with a growth of 2 Times followed by Milk Beverages with 69% growth during Jan-Jun’21 compared to Jan-Jun’20.In terms of growth percentage, the Household Cleaners category witnessed the highest growth % among the Top 10 i.e. 5 Times in the Jan-Jun’21

The top 50 Advertisers on Television accounted for nearly 65% share of Ad Volumes. Around 5400+ advertisers were present on Jan-jun/21. HUL topped the list during Jan-Jun’21 followed by Reckitt. The top 10 advertisers together added 43% share of Ad Volumes. The top 6 brands were from Reckitt Benckiser contributing a 6% share of Ad Volumes together during Jan- Jun’21.

3K+ exclusive advertisers & 5K+ exclusive brands advertised during Jan-Jun’21 compared to Jan-Jun’20. Whitehat Education Technology and Harpic Power Plus 10x Max Clean were the top exclusive advertiser and brands respectively during Jan-Jun’21.

In Jan-Jun’21, News Genre topped with 28% of Ad Volumes closely followed by GEC with almost the same share. All the Top 5 genres registered growth in Ad Volumes during Jan-Jun’21 over Jan-Jun’20 with the Music genre seeing the highest growth of 82%.

Regional and National channels had 56% and 44% share of Ad Volumes respectively during Jan-Jun’21. Toppr Technologies and Aachi Masala Foods were leading exclusive advertisers on National and Regional channels respectively during Jan-Jun’21.

Feature Films was the most preferred program genre in Jan-Jun’21 to promote brands on Television. The top 3 program genres i.e. Feature Films, News Bulletin, and Film Songs together covered 57% of the TV ad volumes in Jan-Jun’21.

On TV, Prime Time was the most preferred time band, followed by Afternoon & Morning.

Together, the Prime Time, Afternoon, and Morning time bands combined for more than 70% of ad volumes.