Ad Volumes of Consumer Durables/Home Appliances category on Television grew by 6% during Jan-Mar’21 compared to the same period in the previous year, as per TAM AdEx ad volume report on Consumer Durables/Home Appliances category.

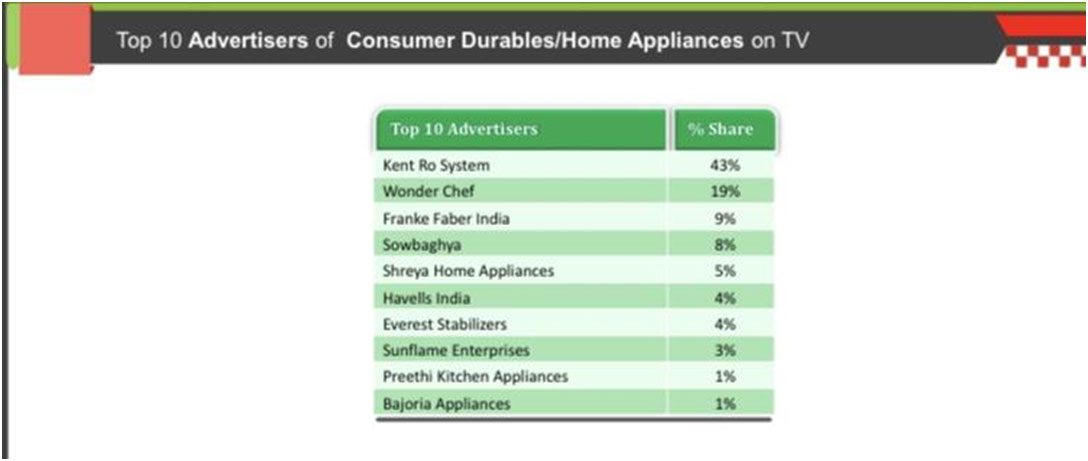

Kent Ro System and Wonder Chef together accounted for more than 60% of the ad volume share of the Consumer Durables/Home Appliances category. Top 10 advertisers accounted for more than 95% share of ad volumes during Jan-Mar’21, with Kent Ro System leading the list.

Top two-channel genres on TV together- News and GEC accounted for more than 75% of ad volumes share for Consumer Durables/Home Appliances category during Jan-Mar’21.

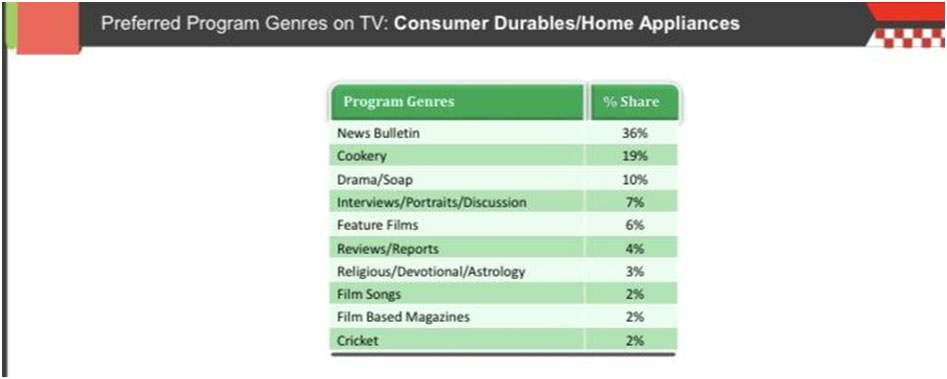

News Bulletin was the most preferred program genre to promote Consumer Durables/Home Appliances’ brands on Television. Top 2 program genres – News Bulletin and Cookery together added 55% of the total ad volume share of the category on TV.

Prime Time was the most preferred time-band on TV, followed by Afternoon time-band. Prime Time, Afternoon & Morning time bands together accounted for 85% share of ad volumes.

Advertisers of Consumer Durables/Home Appliances category preferred <20 secs ad size on TV. < 20 seconds and 20-40 seconds ads together covered almost 100% share of Ad Volumes during Jan- Mar’21.

The Print Ad space for Consumer Durables/Home Appliances grew by 91% during Jan-Mar’21 compared to Jan-Mar’20.

TTK Prestige India was the top advertiser with a 38% share of the overall category’s ad space during Jan- Mar’21, followed by Stovekraft. The Top 10 advertisers accounted for more than 80% of ad space share.

In Print medium, more than 50 new brands were seen during Jan-Mar’21 compared to Jan-Mar’20. Kent Smart Chef Appliances was the top new brand, followed by Lair Range of Products.

The English language was on top with a 34% share of ad space, and the top 5 Publication languages together added 87% share of the category’s ad space. The General Interest publication genre added more than 99% share of the category’s ad space.

Among four zones, South Zone topped for Consumer Durables/Home Appliances advertising with 35% share in Print during Jan-Mar’21. Chennai & Mumbai were Top 2 cities in overall India for the category advertising in Print.

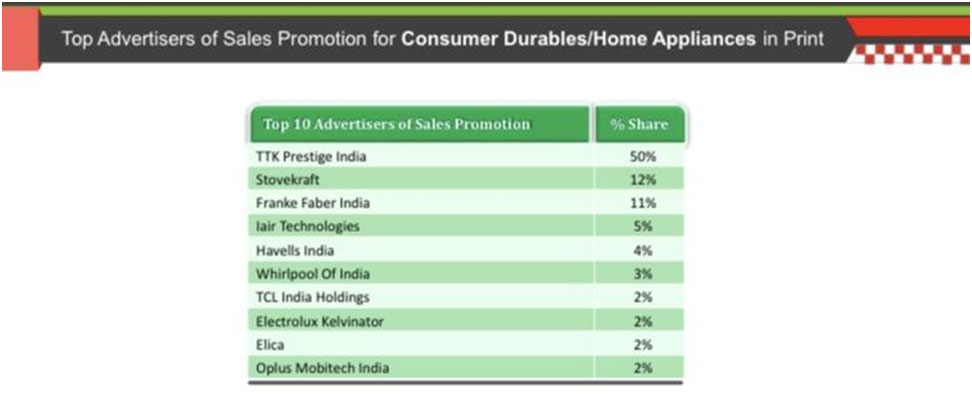

75% share of Print Ad Space for promotional offers during Jan-Mar’21. Among Sales Promotions, Multiple Promotion occupied 67% share of ad space followed by Discount Promotion with 18% share during Jan-Mar’21.

Among the advertisers using promotional offers, TTK Prestige India topped with a 50% share of ad space, followed by Stovekraft during Jan-Mar’21.

Radio

The sharp growth of 2.7 times was registered on Radio medium during Jan-Mar’21 compared to last year.

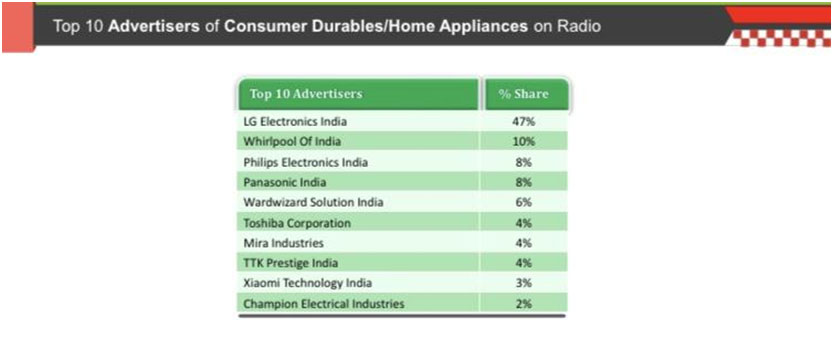

On Radio, LG Electronics India ruled with 47% of the total ad volumes’ share of Consumer Durables/Home Appliances category. Top 10 Advertisers added 96% share of ad volumes during Jan-Mar’21 on Radio.

Whirlpool Durable Range was the top new brand on Radio medium in Jan-Mar’21.

The Top 3 states occupied almost half of the ad pie for the Consumer Durables/Home Appliances category. Andhra Pradesh state was on top with a 17% share of ad volumes, followed by Maharashtra with a 16% share.

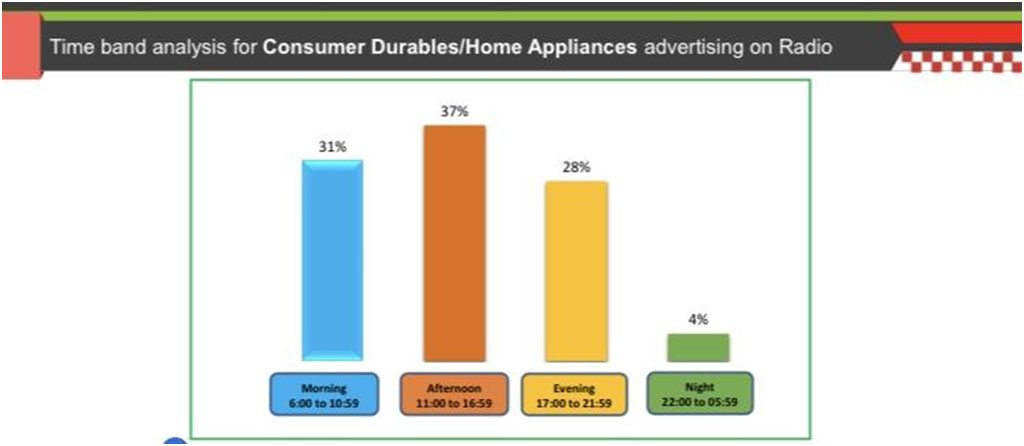

Advertising for Consumer Durables/Home Appliances category was preferred in Afternoon and Morning time-bands on Radio.

68% share of the Consumer Durables/Home Appliances ad volumes were in Afternoon and Morning time-bands during Jan-Mar’21

Digital

A sharp 9 Times growth was observed in ad insertions of Consumer Durables/Home Appliances category on Digital medium during Jan-Mar’21 compared to Jan-Mar’20.

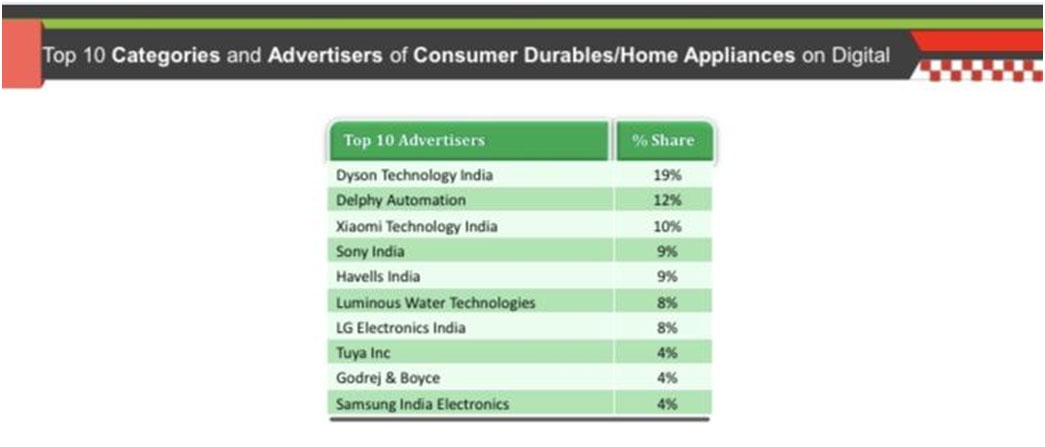

Top 10 Advertisers accounted for 87% share of ad insertions during Jan-Mar’21 with Dyson Technology India leading the list.

Ad Network transaction method was the most utilized for Consumer Durables/Home Appliances ads on Digital followed by Programmatic/Ad Network method.