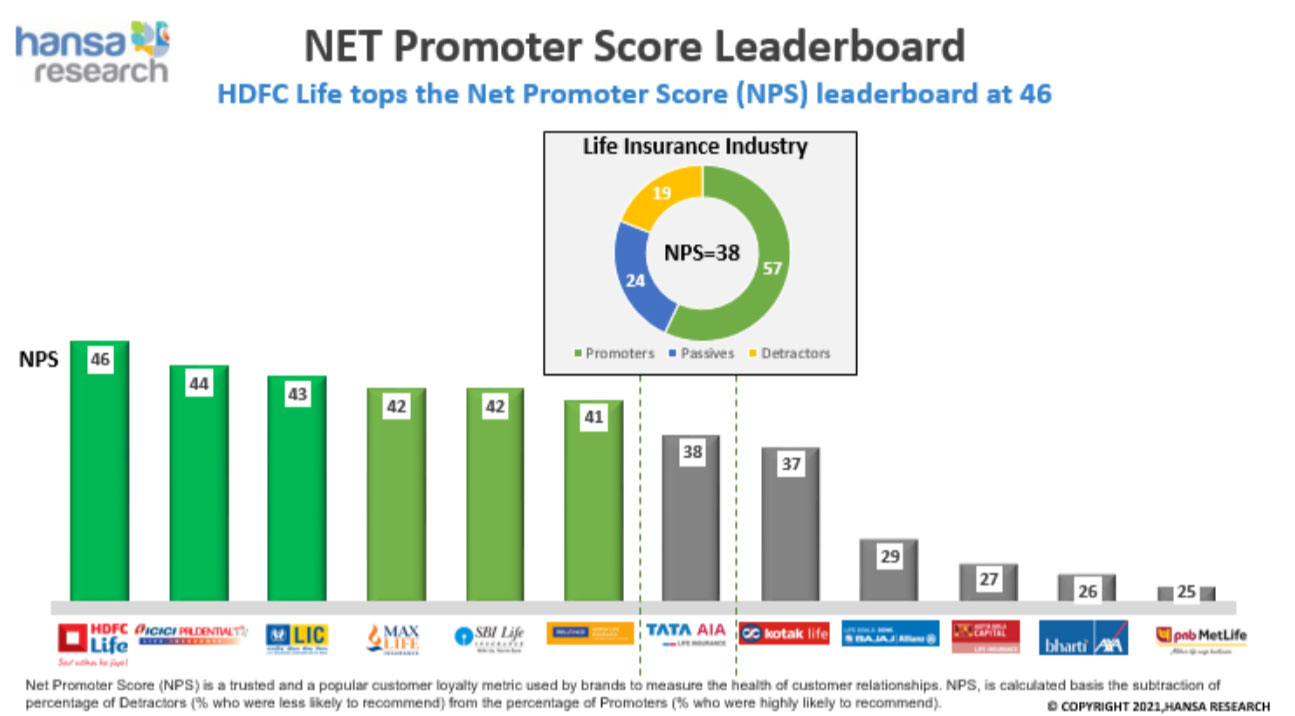

Mumbai: Hansa Research’s Insurance CuES 2021, a syndicated Net Promoter Score Study in the Life Insurance segment shows HDFC Life, taking the lead at #1, with ICICI Prudential Life ranked #2 and LIC ranked #3. The study was conducted in February 2021 and covered 3500 respondents across India.

The study emphasizes the need and importance for brands to invest in building trust among their core consumer base as gaining traction and converting business now meets the new age challenge of retaining customers. Quite a large number of customers still value the comfort that comes with dealing directly with the brand than through its intermediaries. The traditional modes of sales are giving way to new age modes and digitization has played a huge role in the likes of HDFC, ICICI, and Max making maximum headway with customers in terms of NPS (Net Promoter Score).

Digital adoption is being seen as a game-changer as customers seek support, service, and information on policies across demographics such as age and gender. Male and female customers are engaging online by actively seeking assistance and support to make an informed choice via interaction with the Call Centre, Branch RM, Chatbot/chatbox on the website, etc. before purchase. The survey highlights customer preferences for customer support channels as a healthy mix of traditional and digital channels across age groups.

As per the study. LIC continues to have the highest brand awareness across metros and smaller cities. It is perceived to be highly ‘trustworthy’ and has one of the best ‘claim settlement ratios’ however, it loses ground to HDFC Life and ICICI Prudential on account of the gap in experience, especially on the digital front.

Commenting on the launch of the syndicated study, Piyali Chatterjee, Sr. VP, CX, Hansa Research, said, “Brand selection criteria, buying modes, and consumption patterns are changing across categories. This change is evident even in the life insurance category. Customers, especially the millennials are heavily relying on company websites for information before purchase, online purchase of policies has hit new heights. Our survey found that 35% of the life insurance customers stating that they are likely to switch to another life Insurance company or consider cancellation of a policy (without replacement) in the next 6 months this has important implications for companies. Customers are looking closely at the suitability of the product, and how easy is to understand it, along with brand reputation”.

Experience is key for advocacy. And companies need to ensure a seamless customer journey right from the time of purchase and focus on aspects such as time taken to issue a policy, providing status updates, or even issuing a physical document of the policy/plan, etc. Players like HDFC Life, ICICI Prudential Life, Max Life, and SBI Life are seen to out-perform other players on these aspects and hence are ahead on the NPS leader board.