TAM shared its report on Mirroring 2020 for Print Advertising. The report talked about Advertising Overview in Print, Ad Innovations and Position of Ads, Ads with Festive Theme, Sales Promotions and Trends in Unlockdown Period compared to Lockdown.

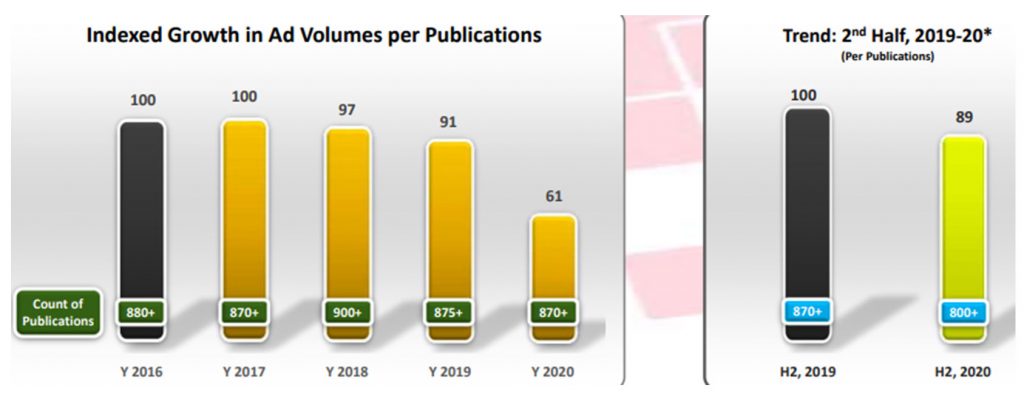

In the trend of Ad Volumes per Publications in Print, 2017 witnessed almost the same avg. Ad Volumes as in Y 2016 while Y 2020 saw 39% decline compared to Y 2016. Compared to Y 2019, Ad space in Y 2020 dropped by 33%. Avg. Ad Volumes per publication drop by only 11% in 2nd halves of Y 2020 over the same period of Y 2019 showing a recovery in Print Ad Volumes during the Unlockdown period.

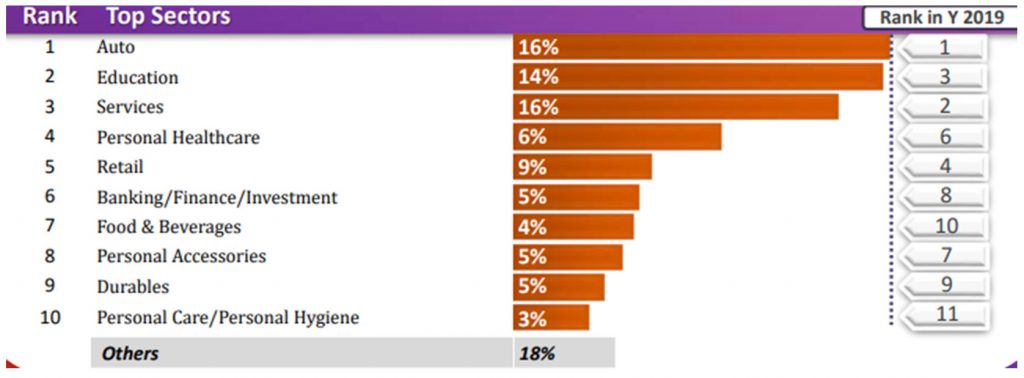

In Leading Sectors, F&B sector moved up by 3 positions and captured 7th position. Auto sector topped with 18% share of Ad Space followed by Education with 14% share during 2020. Whereas, Auto topped 2019 too. Top 3 sectors together added 46% share of Ad Volumes in Print.

In leading Categories, Range of OTC Products, the only new entrant in Top 10 list. The top 2 categories maintained their positions during Y 2020 with an 8% & 7% share of Ad Space respectively. Properties/Real Estates and Multiple Courses moved up by 1 and 2 positions respectively in Y 2020. 2 Out of the Top 10 categories were from Auto and Education sectors each.

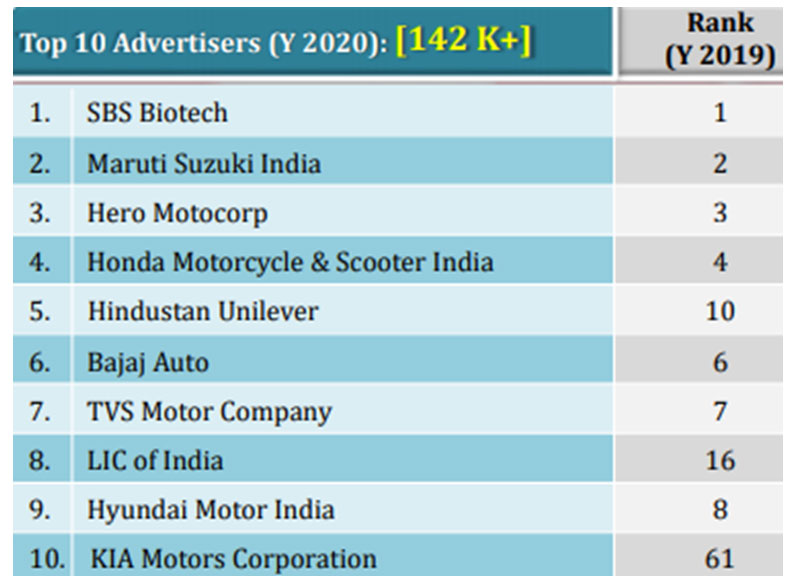

In leading advertisers, Players from the Auto sector dominated the Top 10 List. SBS Biotech topped the advertisers’ list in Print followed by Maruti Suzuki India. Top 4 advertisers maintained their positions during Y 2020. HUL moved to 5th rank in Y 2020 compared to 10th in Y 2019. LIC of India and KIA Motors Corporation moved up by 8 & 51 positions to enter the Top 10 advertiser list of 2020. In leading brands, 6 brands in of the Top 10 belonged Auto sector. Maruti Car Range was the top brand in Print during Y 2020 followed by Hero Two Wheelers. Whereas, Hero Motocorp had its 2 brands among the Top 10 in Print. During Y 2020, there was a total of 172 K+ brands advertised in Print.

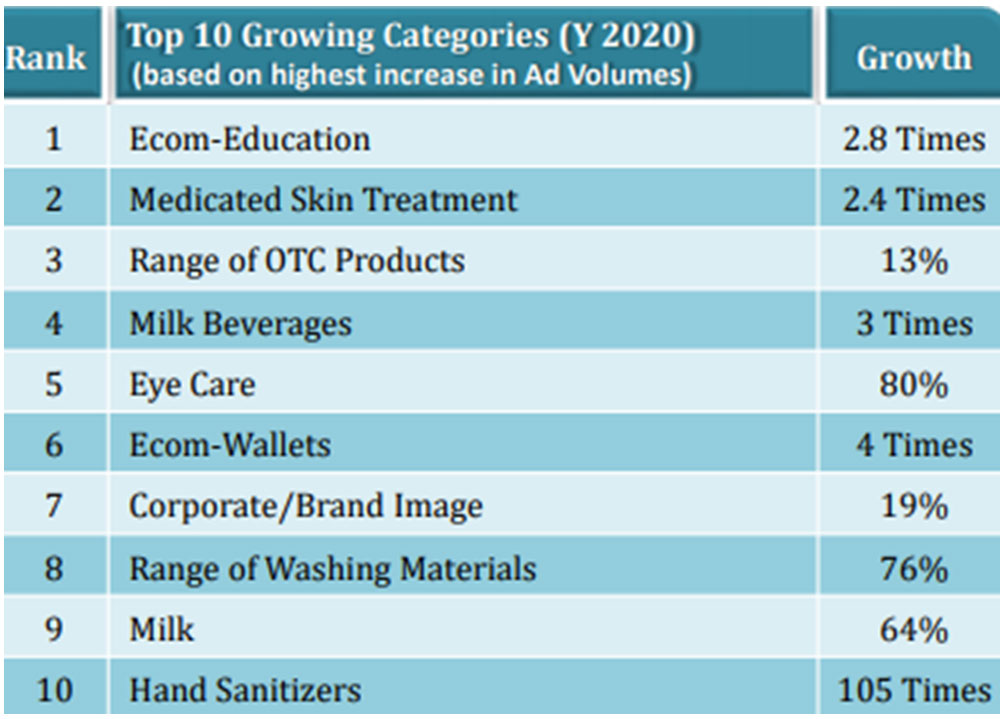

Top Growing Categories had 200+ Categories registered Positive Growth. Ecom-Education among categories saw the highest increase in Ad Space with the growth of 2.8 Times followed by Medicated Skin Treatment with 2.4 Times growth during Y 2020 compared to Y 2019. In terms of growth %, the Hand Sanitizers category witnessed the highest growth % among the Top 10 i.e., 105 Times in the Y 2020.

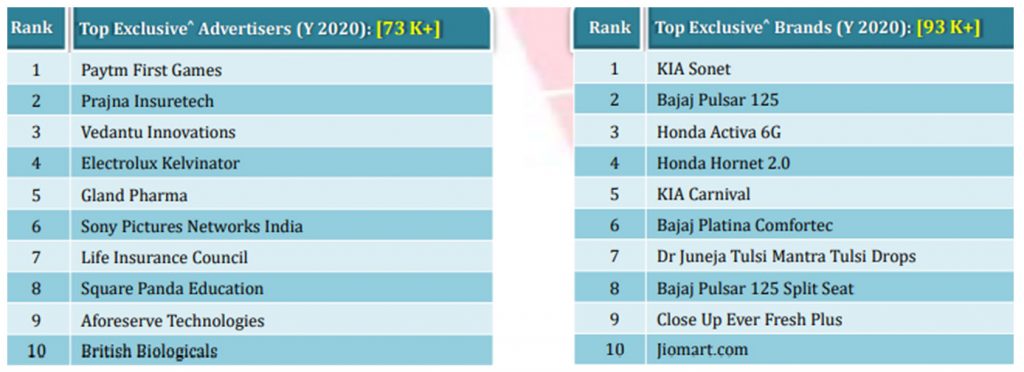

Leading exclusive^ Advertiser and Brands in Y 2020, 73 K+ advertisers & 93 K+ brands exclusively advertised during Y 2020 in Print compared to Y 2019. Paytm First Games and KIA Sonet were the top exclusive^ advertiser and brand respectively in Y 2020 compared to Y 2019.

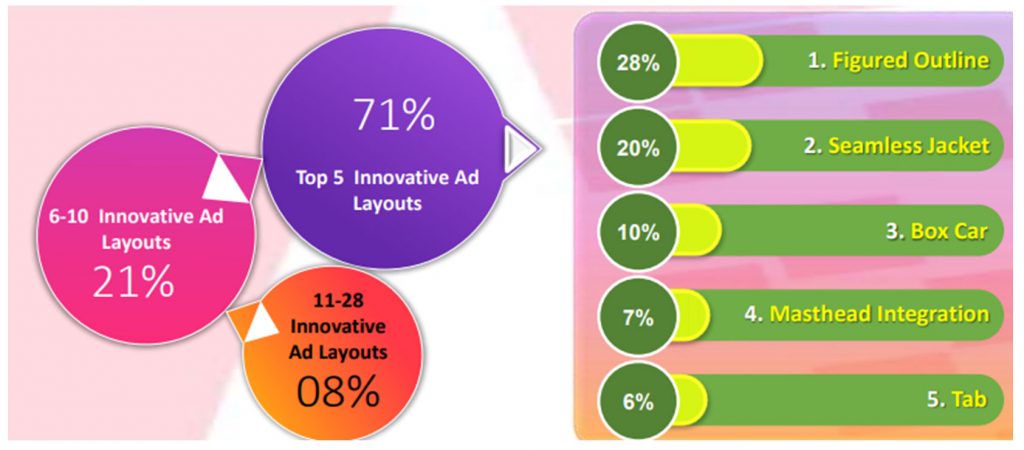

In the Top Innovative Ad Layouts, we saw, Figured Outline topped with 28% share of Ad Space followed by Seamless Jacket with 20% share in the Print medium during Y 2020. In addition to the Top 5 Innovations, there were 23 more Ad Innovations with a total share of 29%. whereas, Top 5 Innovative Ad Layouts together added more than 70% share of Ad Volumes during Y 2020.

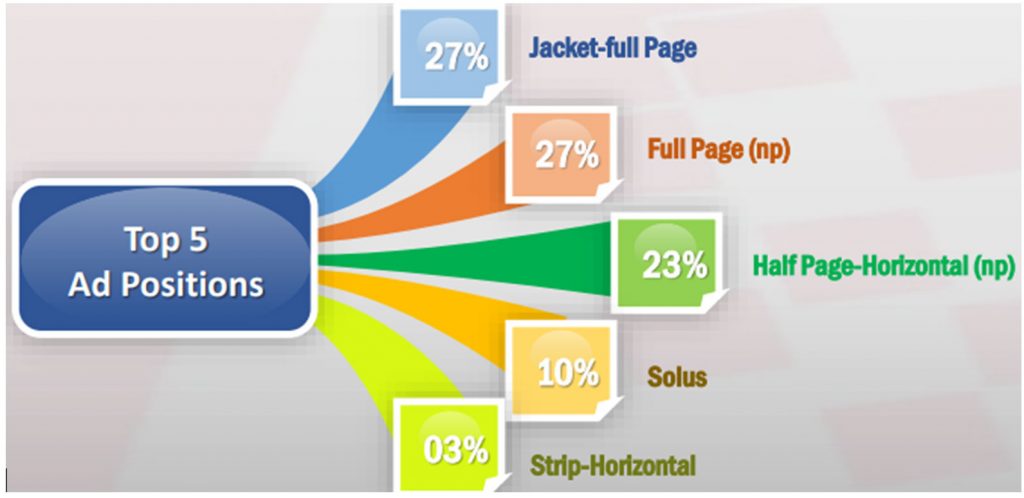

Jacket-Full Page was the most preferred Ad Position by advertisers of Print during Y 2020. 5100+ brands advertised as Jacket-Full Page (Newspaper & Magazine) during Y 2020 among which Fiitjee was the top brand.

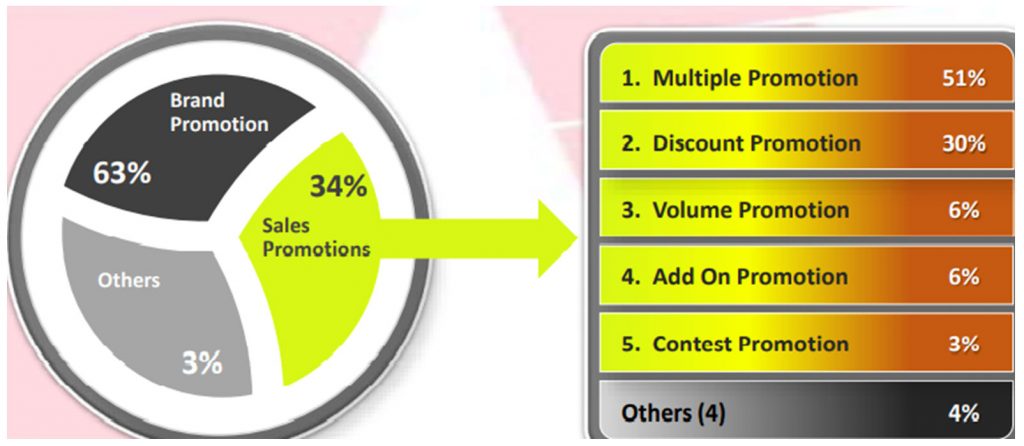

In sales promotion, Sales Promotion advertising covered 34% share of Ad Space in Print during Y 2020. Among Sales Promotions, Multiple Promotion was on top with 51% share of Ad Space followed by Discount Promotion. Top 2 promotions solely covered more than 80% share of Ad Volumes during the year 2020.

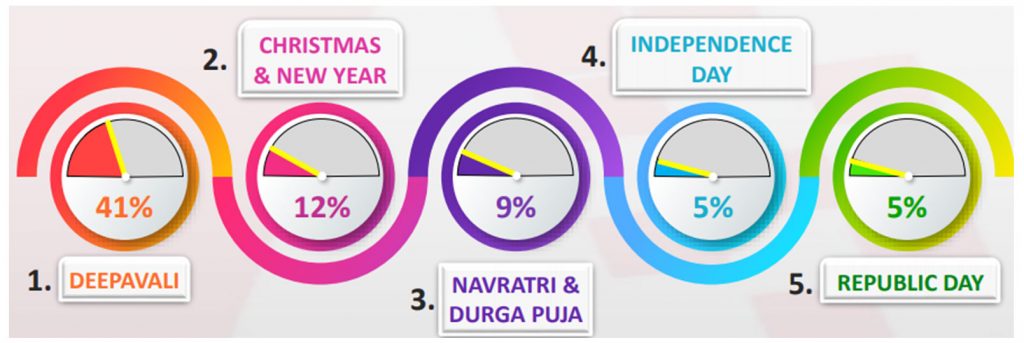

Deepavali was the top festival with a 41% share of Ad Space in Print during Y 2020 followed by Christmas/New Year and Navratri/Durga Puja with 12% & 9% share respectively. The top 3 brands with Deepavali ad themes were Amazon.in, Hero Two Wheelers (Hero Corp.) and Hero Motorcycles.

During Unlockdown, more than 4.8 Times growth seen in Avg. Ad Volumes/Publications/Day compared to Lockdown period. Count of Categories, Advertisers & Brands grew by 36%, 4 Times & 4.5 Times respectively during Unlockdown compared to Lockdown period.