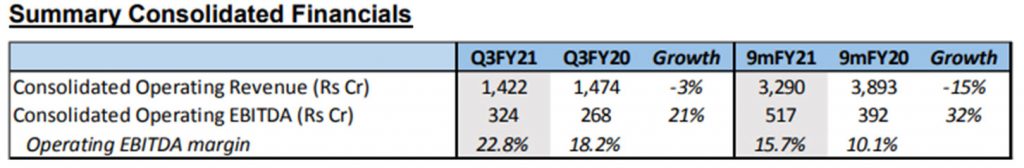

On 19th January Network18 Media & Investments Limited announced its results for the quarter and nine months ended 31st December 2020.

The company reported Q3 operating EBITDA up 21% YoY while operating margins continued to grow to a healthy 23%. Further Ad-recovery and Cost-efficiency drove Entertainment’s EBITDA margin to 25%, which is the highest margin ever. whereas TV News EBITDA margin ramped-up to 19%marking 4 years of consistent improvement. The Digital News of EBITDA margins rose to ~9%, after achieving break-even in the last quarter. The Profit after tax of network 18 rose to Rs 333 Cr, up >2x YoY on improved performance, lower finance costs & tax reversals.

The company has reported Ad-revenue which got inched up YoY; where the Recovery has been sharp and broad-based. Entertainment fully recovered from COVID impact, led by programming returning to normalcy and high-impact content driving ad-yields up during the festive season. Viewership remained strong despite sports (IPL) and peer non-fiction shows competing for eyeballs. Sustained focus on high-quality reportage sans hyperbole continues to bolster the News business, even amidst the absence of BARC ratings during the quarter, the digital news revenue rose over 50% YoY for the second quarter in a row, underscoring the success of our platforms in a fast-growing but hyper-competitive domain.

In the other highlights of the quarter Subscription revenue rose up to 2% YoY; lockdown impact on some consumer segments tapering. While domestic subscription revenue remained strong, offset the stress in international. The improved distribution tie-ups for TV and Digital continue to drive subscription growth for the network.

Cost controls maintained even amidst monetization-linked thrust during the festive season. Where the Opex was down 9% YoY even as they had a full content roster in the festive season and linked thrust on marketing and distribution.

TV and Digital media consumption are growing in tandem, across delivery platforms. TV viewership (ex-News, even as ratings have been blacked out during Q3), remains elevated 10% vs pre-COVID levels on a consistent basis, despite lockdown tapering. Digital consumption of media continues to gain traction and currency, both through direct-to-customer offerings and telco-bundle.

Digital gained momentum led by network-content core, interactivity, and distribution thrust. The company said that the Voot video-views rose 30% QoQ, driven by the complete resumption of network content. With an average daily time spent per viewer (TSV) of over 50 minutes, Voot continued to be a leader amongst direct peers. Niche edutainment product Voot Kids has a TSV of 86 minutes. Apart from digital interactivity in non-fiction TV shows like Bigg Boss being dialed-up, innovative interactive elements were introduced on Voot for even fiction shows. Interactive games were launched as the 5th vertical of Voot Kids.

Adil Zainulbhai, Chairman of Network18, said: “The group has fully recovered from the effects of the pandemic, even as safety measures and innovative solutions to logistical challenges continue to be deployed. We have treated this period as an opportunity to rethink our businesses, and are emerging stronger and ready for the post-COVID world. As TV consumption remains healthy and Digital adoption grows in tandem, we believe the group is well-positioned to straddle the space. The benefits of cost controls affected over the past year are now visible, as all three verticals are at much-improved profitability levels. In this new year that is bringing in new hope, our constant endeavor will be to create value and deliver on our promise of class-leading content.”