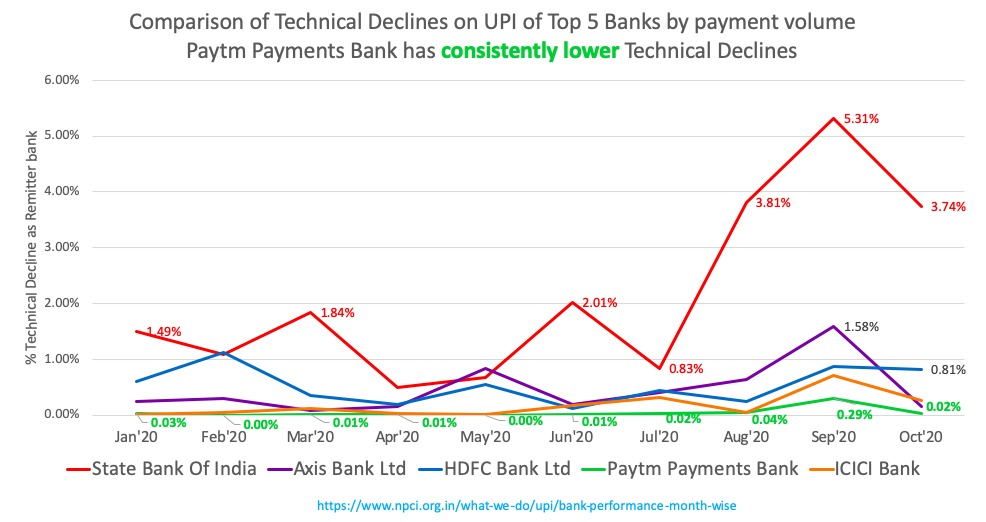

Mumbai: According to the latest report by the National Payments Corporation of India (NPCI), PPBL has the lowest technical decline rate at 0.02% among all UPI remitter banks and 0.04% among all UPI beneficiary banks. All other major banks have a way higher technical decline rate of around 1%.

While for other banks UPI transactions are mostly driven by third-party apps, PPBL organically drives UPI transactions from Paytm’s ecosystem. PPBL already has over 100 million UPI handles on its platform and is accelerating the growth of UPI payments at offline retail stores and even large merchants.

Satish Gupta, MD & CEO of Paytm Payments Bank Ltd said, “Our performance in the latest NPCI report is a testament of the hard work that the team puts in to provide the best technology infrastructure in the global banking space. We are well ahead of others when it comes to leveraging AI and Big Data to offer innovative products & services to our customers across the country. Our tech team which comprises of the best minds in the business, work round the clock to provide a seamless and efficient experience. This has helped us build a trusted & long-lasting relationship with our partners.”