The TAM AdEx-Television Advertising Report-18 based on advertising snapshot during Q3 (Jul-Sep’20) over Q2 (Apr-Jun’20). It highlights Index Growth in Ad Volumes: Q3 (Jul-Sep’20) vs. Q2 (Apr-Jun’20) and Monthly Trend (Apr-Sep’20), Tally of Categories, Advertisers and Brands during Q3 and Q2 on TV, Leading Sectors and Categories in Q3 including rank shift compared to Q2 and much more:

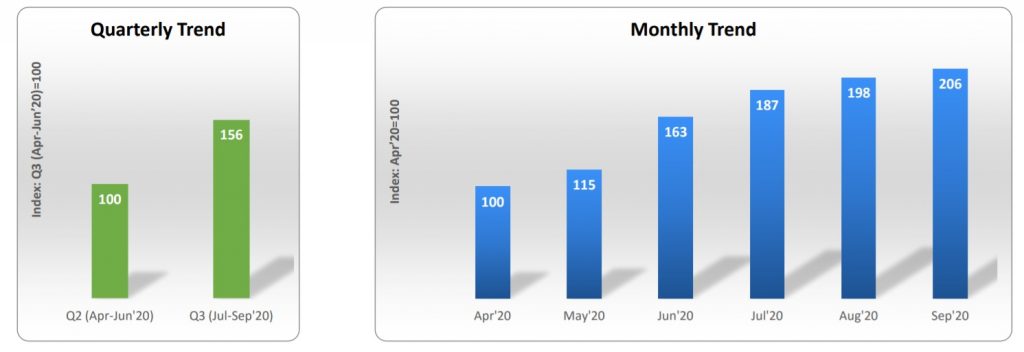

Index Growth in Ad Volumes: Q3 (Jul-Sep’20) vs. Q2 (Apr-Jun’20) and Monthly Trend (Apr-Sep’20)

The report highlights that during Q3’20, ad volumes on TV rose by 56% compared to Q2’20. While ad volumes increased by more than 2 Times in Sep’20 compared to Apr’20 which is highest between Apr-Sep, 2020.

Tally of Categories, Advertisers and Brands during Q3 and Q2 on TV

On TV, No. of categories, advertisers and brands increased by 1%, 19% and 21% respectively during Q3’20 compared to Q2’20.

Leading Sectors and Categories in Q3 including rank shift compared to Q2

While we see that Personal Care/Personal Hygiene sector topped with 21% share of TV advertising in Q3’20 followed by F&B (18%). With 4 of Top 5 Categories belonged to FMCG sector during Q3’20; Shampoos moved from 6th Rank in Q2 to 3rd Rank in Q3. The Top 5 sectors and categories added 68% and 23% share of Ad Volumes respectively in Q3’20.

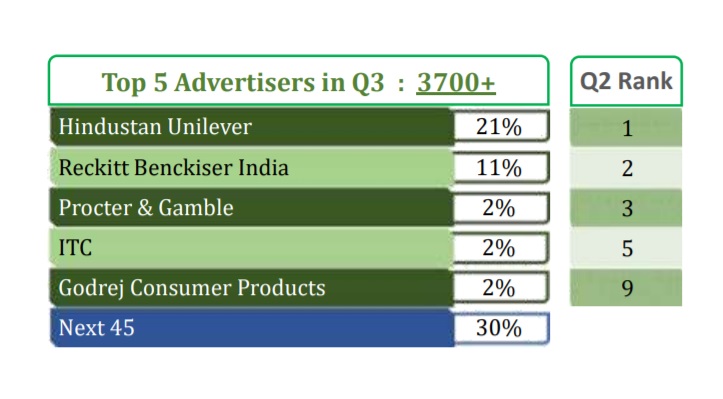

Leading Advertisers in Q3 including rank shift compared to Q2

We see HUL & Reckitt being the Top 2 advertisers in Q3’20 with 21% & 11% share of Ad Volumes respectively. During Q3’20, the Top 5 advertisers added 39% share of TV Ad Volumes and Top 3 advertisers maintained their positions in Q3’20 compared to Q2’20.

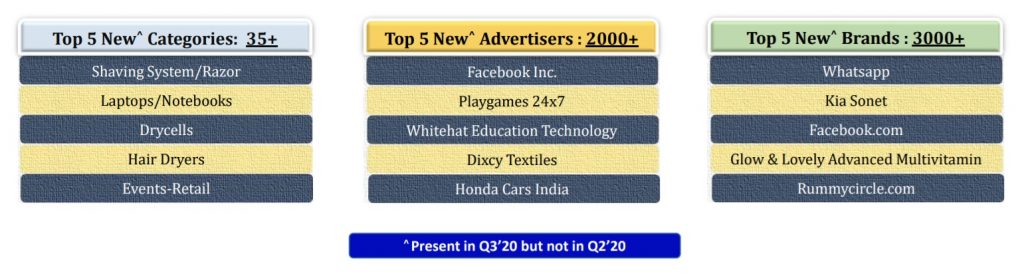

New^ Categories, Advertisers and Brands during Q3 compared to Q2

With a Total of 35+ new categories, 2000+ new advertisers and 3000+ new Brands emerged in Q3’20 compared to Q2’20. Shaving System/Razor, Facebook Inc. and Whatsapp were top new category, advertiser and brand during Q3’20.

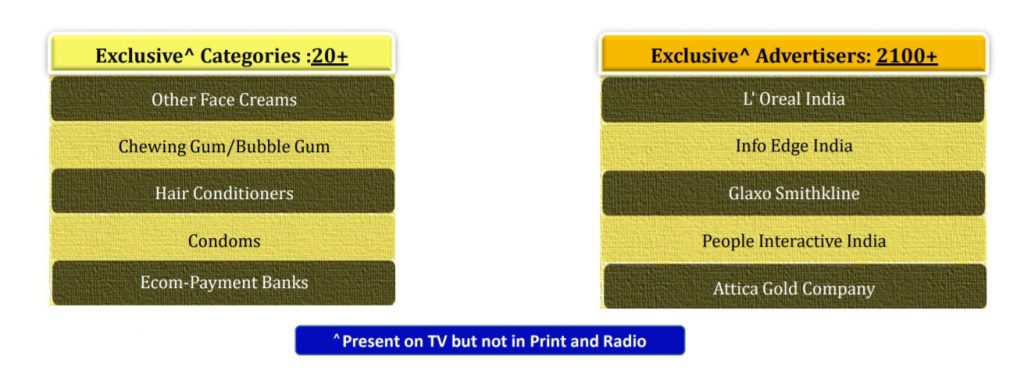

Exclusive Categories and Advertisers on TV Compared to Print and Radio during Q3

With a total of 20+ Exclusive Categories & 2100+ Exclusive Advertisers seen in Q3’20 on TV compared to Print and Radio. Other Face Creams and L’Oreal India were top exclusive category and advertiser on TV during Q3’20.

Top Growing^ Categories and Advertisers in Q3 compared to Q2

Out of Top 5 growing categories, highest growth observed in Cars category that is 5 times. Among the Top 5 growing advertisers, Cadburys India saw highest surge in Ad Volumes during Q3’20 compared to Q2’20.

Index Growth on Top 5 Chanel Genres in Q3 over Q2 and their Share in Q3 and Q2

The report highlights that in Q3’20, News Genre topped with 31% of Ad Volumes followed by GEC (26%) and Movies Genre (24%). While Advertising in News and GEC Genres rose by 42% and 63% respectively during Q3’20 as compared to Q2’20.

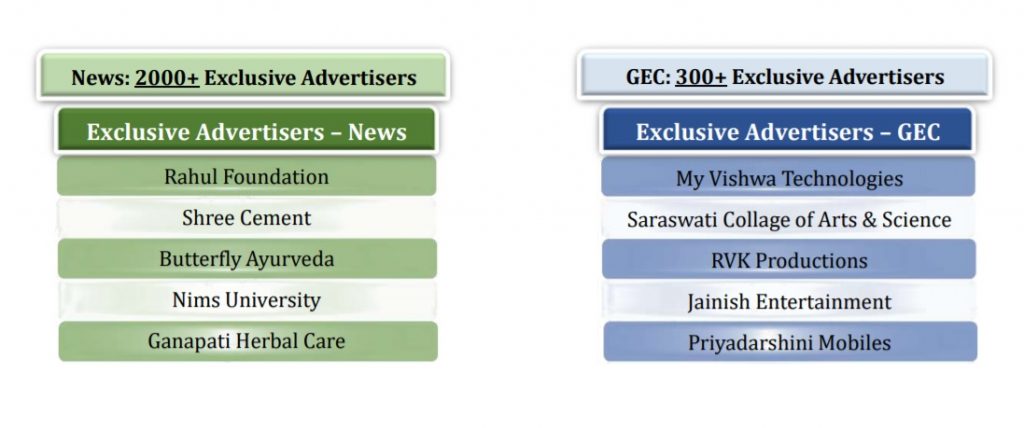

Top 5 Excusive Advertisers on News and GEC Channels Genres during Q3

There were total 2000+ Exclusive Advertisers present in News genre and 300+ Advertisers in GEC genre during Q3’20. Rahul Foundation and My Vishwa Technologies were top exclusive advertiser on News & GEC genres respectively in Q3’20.