Mumbai: The COVID-19 pandemic has significantly changed the psychology of average borrowers. One of the near-time effects will be the growth of non-bank lending. According to a customer survey of Robocash Group in Asia, 50% of respondents say about a higher need for financing. Moreover, the decrease in incomes during quarantine have prepared 45% for active borrowing when restrictions are lifted. At the same time, the other 9% will be motivated by the desire to satisfy their hunger for consumption.

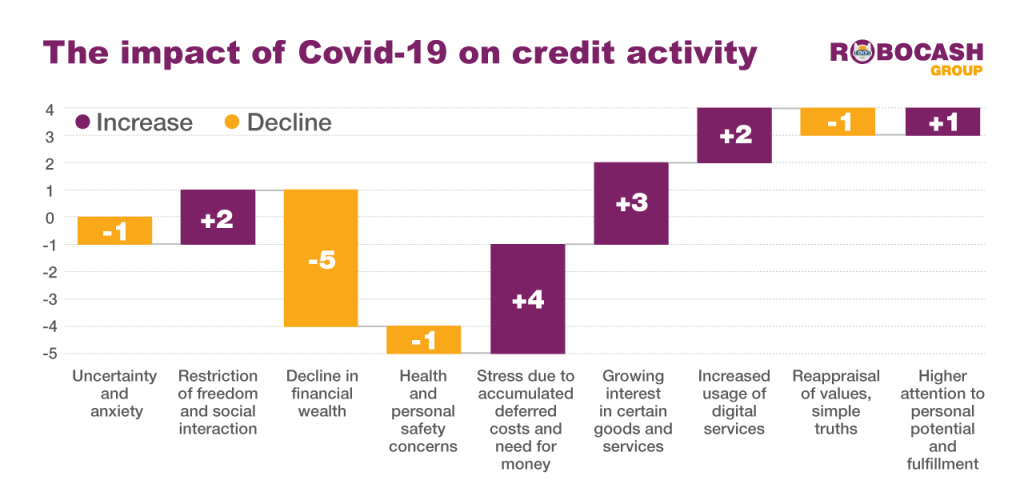

To assess the psychological impact of the pandemic on the future credit activity of borrowers, company analysts identified nine main factors evaluating their positive and negative influence on a 5-point scale. Besides, the results of online customer surveys in the Philippines, Indonesia, Vietnam and India were taken into account.

On the background of the increased need for financing amid the pandemic due to various reasons among half of the respondents, one in four (28%) faced a real drop in income. The decline in financial wealth of the population became the main factor, which reduced the demand for all types of loans during the active phase of the quarantine. Other factors such as overall insecurity and anxiety, established habits to keep social distance and cut down on expenses have strengthened it. The effect will be long-term. Combined with tightened scoring requirements, it will also prevent a sharp surge in lending after the removal of restrictions.

However, the broader usage of digital services with the growing deferred consumption will still gradually prevail over the habits to social isolation and lower spending. The survey results confirm it. An increase in the volume of deferred expenses and the need for money has become stressful for many people. Thus, it will encourage 45% of respondents to borrow more in the post-COVID-19 period. Then, 9% of the surveyed are more likely to resume borrowing because they miss the usual spending.

Analysts of the company added: “Coronavirus has only expedited the expansion of digital and Internet services, boosting the demand for apps providing remote communications, video streaming, online shopping, etc. It has produced a solid base for the further penetration of non-cash payments and fintech.”

Although a far more complex set of factors will affect the outcome such as government policies, the state of alternative lending, the adaptation of traditional banks to the changes etc, psychological and related points allow predicting an increase in volumes for non-bank lending after the complete removal of restrictions. As the findings show, it won’t be sharp but steady.