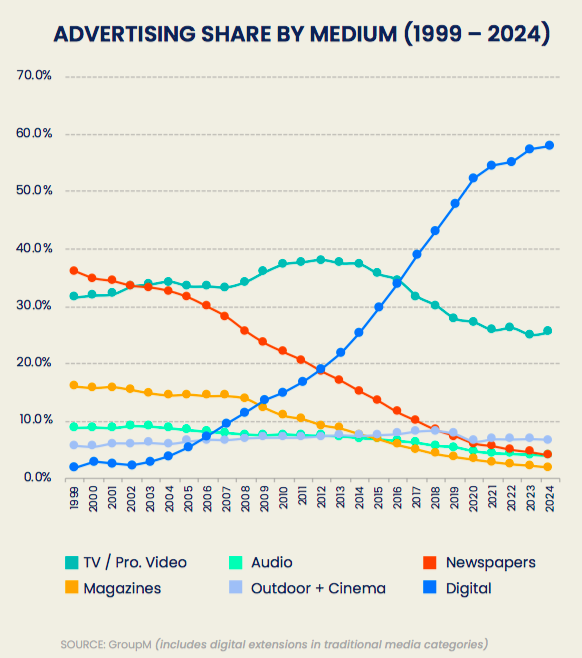

GroupM has released its Global Mid-Year Media Forecast that details how COVID sharply transformed the global advertising economy from a 6.2% growth rate in 2019 to a double-digit decline this year. The report estimates that the global advertising economy will fall by 11.8%, excluding the effects of increased political advertising in the U.S. This is a sharp decline from the growth rate from 2019 and returns the industry to slightly higher than 2017 levels in constant currency terms. However, the report calculates that during 2020, digital advertising will have a 52% share up from 48% in 2019 and 44% in 2018.

Highlighted below is the industry overall forecast:

- Excluding U.S. political advertising, there will be a 11.9% decline during 2020, followed by 8.2% growth next year on a comparable basis.

- This decline can still be considered “modest” given the scale of the impact of the pandemic on global GDP, which will fall much more significantly than it did in the 2009 global financial crisis.

- In that year, when GDP declined by 1%, we estimate that global advertising fell by 11.2%.

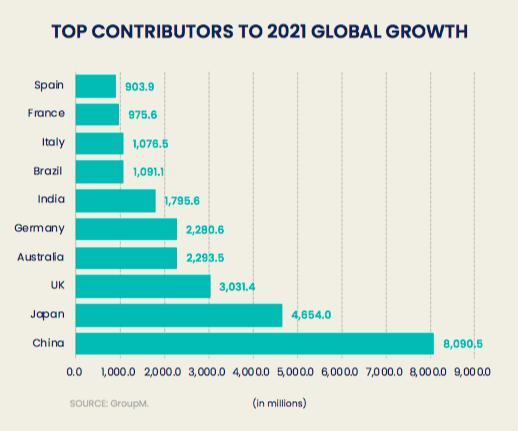

- However, we do see positive news on the horizon as we expect global advertising to grow in 2021 by double digits for half of the top 10 markets and by single digits for the other half.

Here are four areas considered in detail at the midway point of 2020:

- Digital Extensions: We are introducing estimates of “digital extensions,” digital advertising associated with traditional media. These figures are broken out to show the degree to which traditional and digital advertising overlap within individual media types.

We estimate, in 2020, digital extensions of TV, radio, print and outdoor advertising should equate to $31 billion, or 13% of total advertising activity (up from $22 billion, or 7%, five years ago). Digital extensions are most pronounced in the outdoor sector, where they account for $9 billion this year, or 31% of the total outdoor sector’s activities. Digital extensions of traditional television equate to $12 billion this year, 9% of that medium’s total.

- Digital Advertising: expected to decline by 2.3% during 2020. This follows nearly a decade of double-digit growth, with many years exceeding 20% at a global level.

During 2020, digital advertising will have a 52% share of media captured, up from 48% in 2019 and 44% in 2018. Share growth should abate somewhat going forward, adding 1-2% each year. Our new estimates also break out search from non-search digital advertising, with search accounting for $109 billion in revenue during 2020, falling 2.6%. Other forms of digital advertising that account for $172 billion (excluding digital extensions of traditional media) will fall by less, or 0.6% this year.

- Television Advertising: expected to decline by 17.6% in 2020, ex-U.S. political advertising, before rebounding slightly to grow 5.9% next year.

Digital extensions and related media, including advertising associated with traditional media owners’ streaming activities, as well as Hulu, Roku, etc., will fare much better, with growth of +3.7% this year and +11.3% next year – around 9% of total TV spending this year.

Television’s share of advertising, if we define TV including its digital extensions, is expected to be 27% during 2020, down from approximately 37% 10 years ago.

- OOH Advertising: expected to decline by 25.0%, including digital out-of-home media but, next year, we should see a partial rebound with 14.9% growth.

Beyond 2021, we expect outdoor advertising to grow by low or mid-single digits and generally lose share of total advertising, although we do expect larger brands to generally increase their allocations of budgets to the medium.