Bangalore: Adjust, the global app marketing platform, today released a new report on the rapidly-growing market of mobile app commerce in partnership with Liftoff, the leader in mobile app marketing and retargeting. The study, utilizing the most extensive data to date, shows that mobile shopping apps—the global “go-to” for inspiration and assistance in-store and everywhere—continue to experience significant growth. The report identifies North America (NAR) as the mobile shopping leader, while users in APAC – a mature market and early adopters of mobile commerce – show signs of shopping fatigue, with a dip in engagement and conversion rates.

Analyzing more than 53 billion ad impressions across 10 million installs and 2 million first-time events between April 2019 and April 2020, the report found the following:

It’s never been a better time to be a shopping app

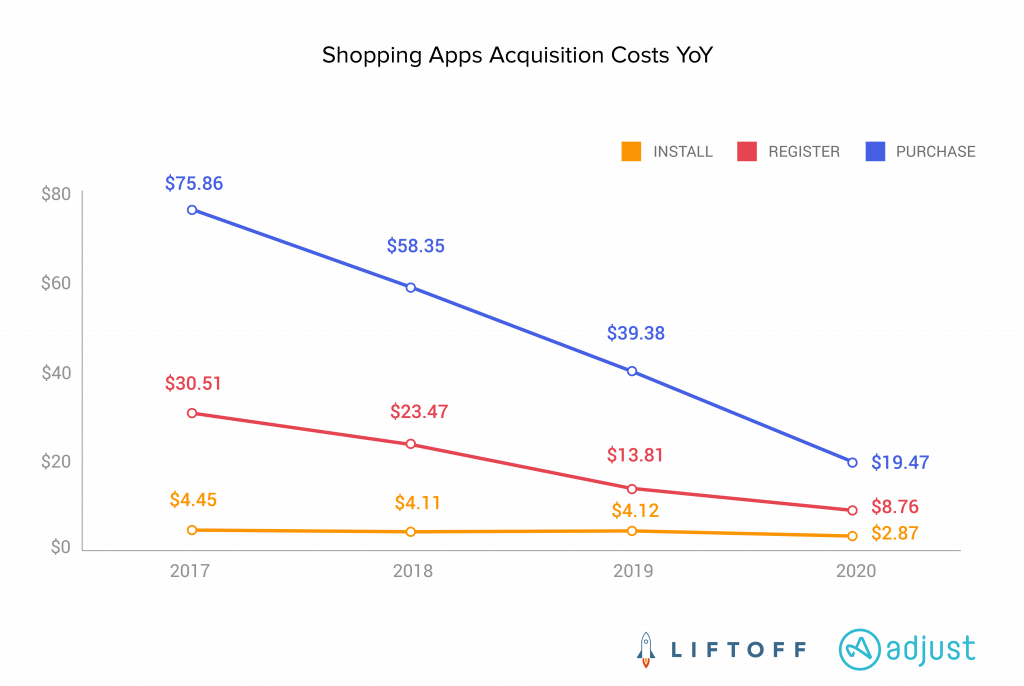

Liftoff and Adjust’s analysis points to increased consumer uptake for shopping apps. At $19.47, the cost to acquire a user who completes a first purchase has decreased by more than half year-over-year. Meanwhile, engagement has surged 40%, as 14.7% purchase rates tower over last year’s 10.5%.

Plus, with COVID-19 driving stay-at-home orders, consumers seem to be utilizing mobile shopping even more readily: while install costs are relatively stable throughout the year, they drop to their annual low of $2.48 in March 2020 — just as shelter-in-place peaked.

“Last year, our analysis found that the rise of sales bonanzas from retail giants like Amazon, Flipkart and Alibaba were tilling the soil for other retailers, priming mobile users to shop year-round, and this trend is only continuing,” explained Mark Ellis, co-founder and CEO of Liftoff. “As consumers adapt to the changing retail landscape, they’re leaning on mobile more than ever. It’s never been a better time to be a retail app marketer.”

In a world where physical touchpoints are reduced, apps position brands to keep driving growth. And according to the data from Adjust, companies have already stepped up their game by focusing on re-engaging and retaining their users.

“The e-commerce industry as a whole got a bit shell-shocked in the first few weeks of March in the wake of COVID-19, with marketers dialing back ad spend,” said Paul H. Müller, co-founder and CTO of Adjust. “But as we saw the vertical start to rebound in April, there’s been a broader push toward re-targeting and re-engagement — in line with bringing customers back into the funnel and keeping their existing ones engaged.”

APAC shows shopping fatigue while North America surges

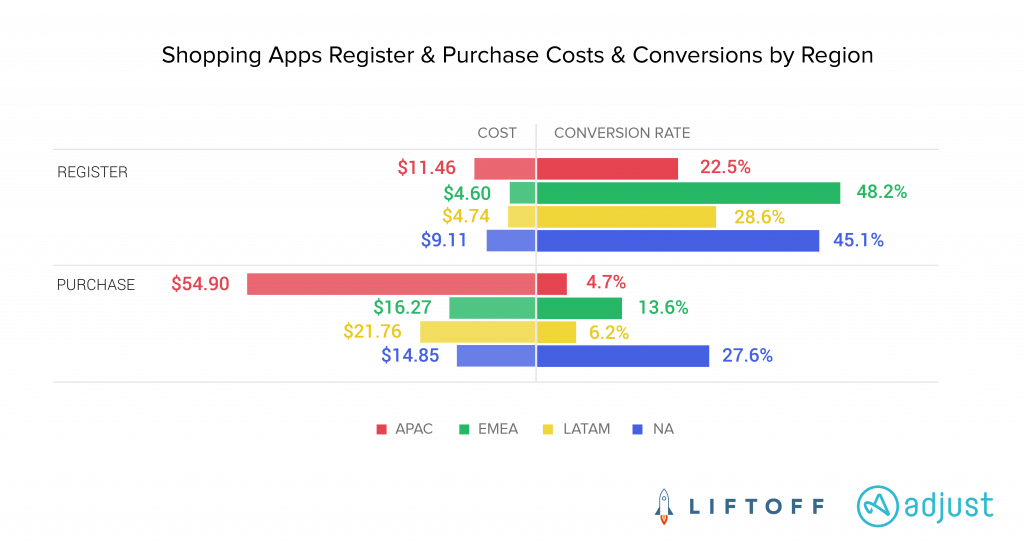

Last year, the mature markets of APAC and NAR showed similar trends. While users were registering more readily for shopping apps, converting to purchases was a challenge, suggesting that users in these regions were ‘window shopping’ on mobile. However, the data shows a major flip this year: APAC and NAR usage patterns diverge, with North America coming out in front.

Costs-per-first-purchase in NAR are down 4x (to a low $14.85), while conversion rates are up more than 4x — 6x higher than that of APAC (27.6% compared to APAC’s 4.7%). Meanwhile, APAC costs have nearly doubled in the past year, up to $54.90. The region finishes last in engagement with purchase rates less than half that of last year, suggesting the region is ripe for a refresh. However, the region also offers significant value for money – CPIs (Cost Per Installs) dropped significantly between 2018 and 2019 (from $3.17 to $2.58).

For more details and to download the full report

visit: https://www.adjust.com/resources/ebooks/shopping-app-report-2020