The business world has been an endless battlefield through which firms engage in competitive warfare for a dominant position. Seldom in Business World, a business leader comes around which blunts all strategic thinking of many organizations together, and suddenly the world is tilted upside down, leading to the reorientation of the many industries together. We are fortunate to live in an era of Amazon, which is disrupting many industries together and that too with ease and comfort.

Amazon is a disrupter of business rather than the creator of any new business, it started off as an online bookseller taking on retail stores, the whole focus at the time was selling books and slowly and steadily it rammed into every aspect of business disrupting multiple businesses with the growth of the internet.

Amazon is successful only because of the Internet, absolutely no, Internet did bloom the ambition of Jeff Bezos, but the main mojo of Amazon is JEFFISM.

JEFFISM focused on what has not changed rather than asking what is going to change?

Jeff Bezos once explained why this was critical.

I very frequently get the question: “What’s going to change in the next 10 years?” That’s a very interesting question.

I almost never get the question: “What’s not going to change in the next 10 years?” And I submit to you that that second question is actually the more important of the two.

You can build a business strategy around the things that are stable in time. In our retail business, we know that consumers want low prices, and I know that’s going to be true 10 years from now.

They want fast delivery; they want vast selection. It’s impossible to imagine a future 10 years from now where a customer comes up and says, “Jeff I love Amazon, I just wish the prices were a little higher.” Or, “I love Amazon, I just wish you’d deliver a little slower.” Impossible.

The strategy has been so simple but not easy but gives Amazon a great MOAT. Matt Brice Brilliantly describes MOAT,

A Bezos Moat is premised on the idea that the customer is willingly and is frequently entering into a commercial transaction with the company because the customer is deriving more value from the transaction than he or she is paying for.

“A Buffett Moat attempts to identify companies that will be the only one (or one of a few) available in a commercial landscape, so that the customer is, in effect, forced to transact with these companies (i.e. only bridge, only newspaper, only soft drink option).”

Jeffism thrives on 3 Buckets which notably makes Amazon not only a B52 Bomber, but it also possesses the velocity of a speed boat with outstanding navigation capabilities of disrupting the incumbent. Let us try to distill each into detail.

- Long Term Focus: Jeffisim thrives itself on long term orientation, multiple business owners pronounce themselves to be long term, in reality, they are impatient for even a quarter. Reality is totally different when it is playing out, rather than writing a beautiful story in the annual report. Jeffisim means sacrificing profits short term to make an enduring profit for the long term. Morgan housel marvels when he writes “Every successful investment is some combination of change that drives competition and things staying the same that drives compounding.” There are so few exceptions to this, regardless of size or industry. Jeffisim has driven compounding to another level, where even Einstein from heaven would be screaming this is what I was always stating compounding is the 8th wonder of the world and Amazon breathes it daily.

- Customer Centricity: Jeffism is all about the customer at the center in the true sense, a lot of companies do have brilliant PR written around how they have changed and trained their staff for customer-focused approach, only to be ridiculed later by the customer themselves. How many companies truly spend to the benefit of the consumer? Very few, only a minority. Jeffism spends close to $40 billion on shipment costs and they see this truly as an investment for the future. Amazon has over 140 Million Prime members and with free shipping and content to watch at disposal at a fraction of a cost with the huge inventory at disposal on a click is a sublime proposition.

- Free Cash Flows over GAAP Earnings. In Jeff Bezos’ 2004 Annual Shareholder Letter, he provided a great lesson for investors on the importance of focusing on free cash flow, as opposed to earnings. Here’s an excerpt from that letter:

“Our ultimate financial measure, and the one we most want to drive over the long-term, is free cash flow per share.”

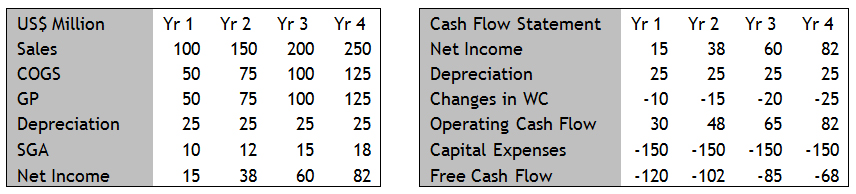

It is very vital to understand the value of free cash over GAAP earnings and why Jeffisim is absolutely spot on to choose Free Cash Flow. Given below is an example of Firm A:

Net-income every year for the firm has been growing, cumulatively NI is 195 Million dollars and cumulative negative free cash flow is 375 Million Dollars. Amazon has always focused on FCF and that is the most important variable to focus on.

The Journey of Amazon is nothing but a miracle in the business world, Jeff’s greatness lies in his ability to combine the penetrative mind of a surgeon and innovator with the forward-looking fanaticism of a startup founder.

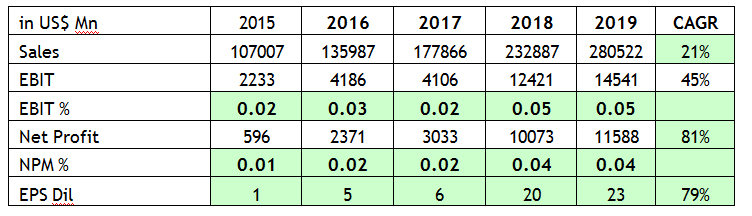

The financial impact of following Jeffism as a strategy is monumental on Amazon, given below is the snapshot:

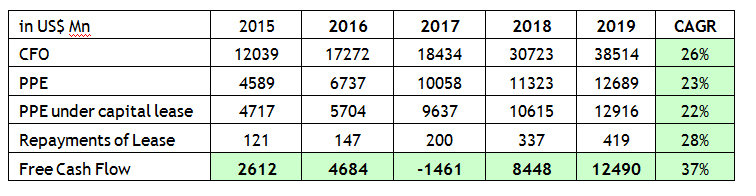

Free Cash Flow Engine of Amazon:

The impact of Jeffism as a strategy has been marvelous on the financials of the business Free cash flow has grown at a CAGR of 37%, Net-Income at 81%, EPS at 79% and Top-Line at 21%. The financial engine is working precisely like a B52 Bomber, where the flight of the beast scares the enemy, the same way Amazon’s announcement of entering a market place destroys billions of dollars of market cap, and incumbent players worry more about Amazon than their own competitors. The Volvo CEO was recently warning his dealers, that Amazon would come after the auto industry, Jeff has a clear path “Your Margin is my opportunity”.

Capitalism is brutal and with the passage of time, strong companies become weaker and new companies do come up and displace the incumbent, the biggest hurdle in displacing Amazon which we see is, Amazon behaves like a startup, it has no respect for rules of the incumbent industry, it is willing to fail and fail big, it is willing to bet huge on consumer benefits, the e-commerce platform in which it operates has such a long runway that growth is perpetual like a river, and most importantly it has JEFF BEZOS at its HELM.

The only way out to displace Amazon is to figure out a talent like Alfred Nobel and tell him to invent something more powerful than his past predecessor. Alfred Nobel was the genius who married nitroglycerin to the stability of gunpowder and he termed the compound Dynamite, his successor if found has a tougher job to do, till that time enjoy the Jeffism Journey.

By Value investors Tanvi Mehta, Ramaswamy Ranganathan & Sudaarshan R .