The Auto Category is one of the most competitive industries globally, the category no doubt has added convenience to human mankind, but popularity rarely does get you the returns. Think for a while, airlines are one of the most crucial innovations for mankind, yet majority of them don’t make money. Auto category has similarities to the airline business.

In America the category had 2000 players in early 1900s and come today barely few have survived, so much for innovation and auto industry has had tremendous impact on America and the world, but the effect for the investors have been in the opposite. In this dark cloud industry, you would still find a GEM which works as if it is in the Auto industry but has all the workings of a defying gravity of the industry as if it has unmerited grace from divine. The Brand in conversation is Ferrari, which has defied the odds of the industry, and has truly come out as a winner in this business.

Ferrari has been in operation for decades and its competition is from multiple players. In the sports and hybrid category competition is from Lamborghini, McLaren, Ford, Honda, Porsche, Mercedes, Aston Martin and in the GT category its Rolls-Royce, Bentley, BMW, Aston Martin and Mercedes as these player’s attack with an upgrade strategy.

Ferrari has unprecedented competition, and with competition comes the role of strategy. The allied victory in the second world war highlighted the necessity of grand strategy for success in warfare and with passage of time, Chief Executives defined their own battlefield and devised strategy to emerge victorious.

The competitive strategy of Ferrari is built on 3 factors:

- Exclusive Club – A small but highly engaged, passionate car aficionados with access to Clubs, Museums, Plant visits, special launch event promotion.

- Switching cost: The higher the cost of switching, the less likely an individual would be willing to switch brands, products, services etc. 41% of repeat purchase from existing customers is a proof.

- “Fanatics” One-Offs: Ferrari P80/C took 4 years to co-create this race car a marque product. Alessandro Pier Guidi the owner was ecstatic about the braking, aerodynamics, speed, power of the engine incorporating features of past F1 winning cars- a testimony to passion for excellence.

Ferrari drives its marketing through F1 which receives unique viewership of 400 odd million people globally. Formula 1 events aid in promoting partners, hosting clients in Ferrari Formula 1 club activities, launching road cars through the F1 drivers and selling old cars. Museums host over 6 Lac visitors every year at both Maranello and Modena to make it exclusive. Ferrari memorabilia, branded products build engagement and connect with the consumers.

The above advantages create a “lollapalooza” in the consumer’s mind with dominant shares for the business. Ferrari sells about (10131) cars mainly in EMEA, America (75%) & APAC (25%).

Strategy followed by a company eventually translates itself into an underlying unit economics, which is the hallmark of business strategy, it cumulatively drives the financial aspect of the business making a landfall in the P&L and Balance-sheet

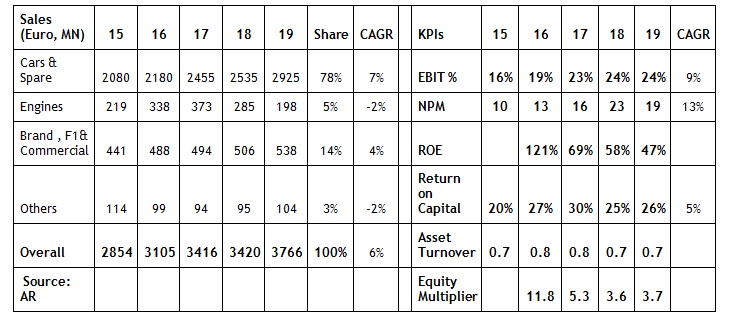

The underlying economics of any brand is in its key financial parameters. The key to success is how does the brand deliver value to its capital owners? The table below represents Ferrari’s business performance basis parameters like operating margin, asset turnover, return on capital. (Source Annual Report, Ferrari)

Ferrari generates more than 90% from car sales and F1. The robust operating margin of 24% beats the global auto sector by huge margins which is unprecedented. High ROE of 50% and ROC ~ 25% implies the brand has pricing power as well.

Faster growth indicates that an asset is worth more. The catch is that a firm must earn incremental profits sufficient to provide an adequate return on capital involved. No matter how fast an enterprise grows, but does not beat the cost of capital, the DCF value will not increase.

For any shareholder, he may be the legal owner of the Business, but most of the value of the asset is beyond his control, and hence management with fiduciary mindset matters and Ferrari had a great chairman.

Former Chairman Sergio Marchionne, who died in 2018, championed the Brand Diversification strategy. He believed the auto category was a tough business as it was a low growth, low margin business with huge reinvestments. This statement is a testimony to the fact the chairman had understood the pulse of the business and crafted a strategy to defy the laws of physics for an auto brand.

Our current offerings are too stretched and are in danger of diluting our very precious brand equity,” CEO Louis Camilleri told analysts, according to Bloomberg in 2019. Within the next seven to 10 years, Ferrari sees its branded luxury goods contributing 10% of earnings before interest and tax (EBIT).

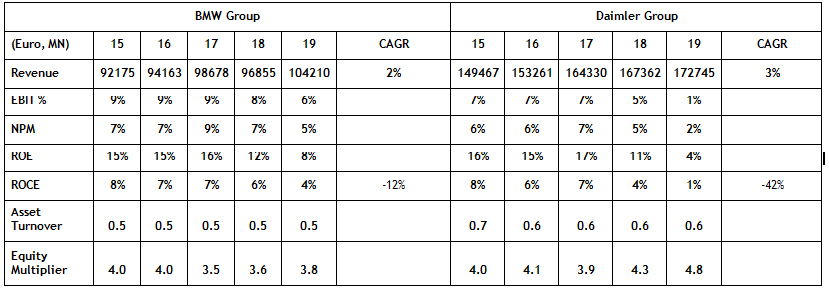

As professors of valuation, we always ask the MBA students to guess the margins of Mercedes and BMW and we have always got an answer of 30% and upwards and when we do put up the numbers reality hits them very hard, both brands are luxury brands and extremely popular in their own right but 30% Margins seem a distant dream for both.

Comparing the underlying economics of BMW & Mercedes who are in the premium space gives a broader perspective on the competitive dynamics:

BMW and Daimler have a very poor record of ROCE and ROE relative to Ferrari. BMW ROE has slid from 15% to 8% and for Daimler it has slid from 16% to 4%, if you talk of ROCE it is brutal. Ferrari has been a stupendous success in relative terms and in the auto category it’s been a star.

Charlie Munger, Vice Chairman Berkshire Hathaway asserts “The automobile business is extremely competitive as everyone relies on the same supplier, cars do last longer with little service and leases of cars are at cheap rents. This has earmarks of a commoditised business and market will shrink one of these days.”

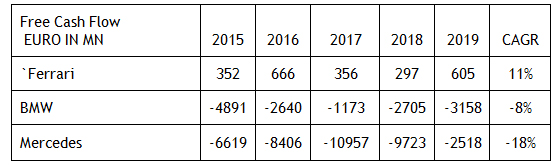

Investment theory states that a business is worth the sum of its cash flows in the future, discounted back to today. Free Cash Flows are the lifeblood of any business and let us dwell into the same.

Tabulating the FCF trend gives a perspective of whether the business is making money.

Ferrari free cash flow leak to sales is 16.6% in 2019 and its growing at 11% CAGR while large players like BMW & Mercedes are facing huge headwinds due to heavy reinvestments in the business and their FCF is negative.

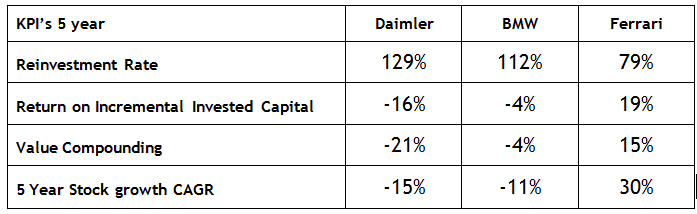

As an investor it’s imperative to understand the business structure, how much value it returns to its shareholders. The table below deconstructs the returns for the investor by each player.

Ferrari as a brand has delivered great returns for the capital owners @ 30% while ROIC is 19%. Daimler’s ROIIC is -17% and which is precisely reflecting in the stock price (-15%) and BMW has been reinvesting at 112% and its ROIIC has been -4% but stock has dropped 11% CAGR in terms of value. Both BMW & Daimler have lost a lot of value which reflects the structure of the business.

As Richard P Rumelt has stated, Good strategy requires leaders who are willing and able to say no to a wide variety of actions and interests. Strategy is at least as much about what an organisation does not do as it is about what it does, Ferrari has been a gold standard in not only doing things, but most important in not doing many things which has contributed to its success as much as has the strategy of doing things.

By Tanvi Mehta, Ramaswamy Ranganathan and Sudaarshan R .