VISA represents human zeal to build connections and create networks enabling commerce. From being Bank of America Cards (BOFA) in 1958 to the becoming the leader in the digital payments landscape, innovations & seamless acceptance has been its hallmark. Visa holder is empowered and feels that the “WORLD IS IN HIS PURSE”.

VISA’s accent on Trust, Security & Privacy, talent, and technology form the linchpin of its competitive advantage. This has enabled VISA’s role in money management globally and has enabled to lead the change in all the aspects of “New Payment Flows” viz P2P, G2C, B2C, B2B powered by VISA Direct, Earth pot, Verify, etc. Partnerships, Ventures, Ecommerce, Tap to pay have been added to the core operations. In January, it has acquired Plaid a technology company in fintech space.

VISA does not issue cards but the bank does and the merchant accepts the cards. This triangulation of VISA, banks, and merchants creates a network effect further leading to a “Domino Effect”

The card network business has one of the highest barriers to entry of any industry group and global commerce has no real alternative to credit/debit card usage. Visa has always enjoyed a sizeable lead over the other three networks in all aspects of their business.

The Network Effect at Play

During the 2019 fiscal there were 201.9 billion transactions & on an average of 553 million transactions a day out of which VISA processed close to 70% of the transactions (138.1 Billion). 15500 financial institutions globally power their core business solutions using VISA. It’s breathtaking to know that VISA can handle 65000 transactions every second!

Total cash and payment volume on VISA was to the tune of US$ 11.6 Trillion and more than 3.4 billion cards were accepted at 61 million merchant locations across 200 countries. It is empowering close to 500 million for financial and digital inclusion (World Bank goal of Universal Financial Access by 2020 – 1.7 billion were laggards digitally)

Network effect impacts marketing ROI and not the other way round. VISA is the most preferred brand across key markets in the world. VISA invests and ensures that the partners grow as well. The advertising budget of US$ 1 Bn helps reinforce the brand power through association with large scale events like Olympics and sensory branding. Sensory branding cues usherin creating visas brand promise of speed, security, reliability, and trust is behind every transaction that makes the customer secure.

Brand VISA’s lead is stellar in terms of preference viz 68% vis-à-vis 16% and 10% for the next two competitors in the USA. (Source: Simmons Proprietary Research – Investor Day presentation 2017)

Marketing Guru Al Ries and Jack Trout have spoken about “Share of Mind” that translates into market share.

Let’s take a quick glance at the competitive snapshot for the Year 2018… (Source VISA Annual Report)

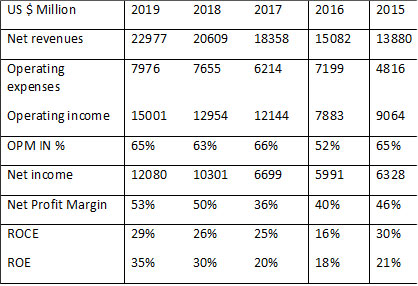

VISA is not only a leader in terms of revenues and transactions but is able to translate the competitive advantage to the critical financial parameters of the business:Source: Annual Report 2019

The industry structure in which VISA operates is a duopoly that creates a MOAT & this enables to the maintenance of the “PRICING POWER” intact ~ margins for VISA – 65% OPM and 53% NPM.

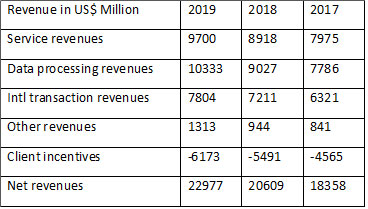

It has paid US$ 15 bn in client incentives in the last 3 years ensuring a win-win. The business is service-led and builds around technology and data processing offering a huge tailwind for VISA enabling “Operating Leverage” to kick in on a fixed network backbone. International markets account for close to 55% of the revenues and will grow further in the future. Visa is accelerating to move US$ 17 Trillion of consumer spending and US$ 15-20 Trillion done in cash to its cards and digital network.

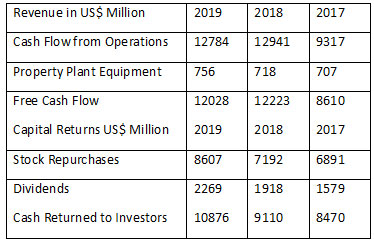

VISA generates free cash flow and rewards its investors generously.

It has returned over 86% of the Free Cash it has generated in the last 3 years.

VISA brand epitomizes good business & empowers billions in a perfectly legal way.

By Tanvi Mehta, Ramaswamy Ranganathan and Sudarshan Rajan, who are value investors and also teach Behavioral Economics & Valuation in leading Business Schools.