Mumbai: India Ratings and Research (Fitch Group) believes the 10% import duty on the newsprint papers announced in the Union Budget FY20 on 5 July 2019 would lead to an improvement in the realisations and volumes of domestic newsprint producers. With imports having become expensive, the share of domestic newsprint in the total consumption is likely to increase. This would improve the overall capacity utilisation of domestic newsprint producers. The import duty, however, could negatively impact the EBITDA margins of domestic print media companies, particularly the English language dailies that rely heavily on the imported newsprint.

Domestic Producers to Benefit: An increase in import prices would create a favourable environment for domestic players to hike their prices by 4%-6% while still remaining competitive. Also, the imposition of the duty might encourage print media companies to reduce their imports, and this could help improve the capacity utilisations of domestic players, bolstering their cost efficiency. Consequently, the share of domestic manufacturers in the total consumption could witness an increase. The pace of the shift towards domestic newsprint would, however, depend on the availability of quality newsprint that is compatible with the machines of print media companies.

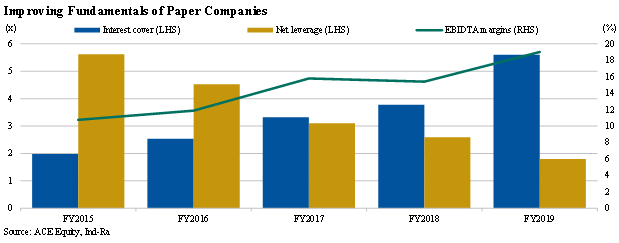

The fall in international newsprint prices since 4QFY19 had forced domestic players to reduce prices, and they had been set to witness a decline in their EBITDA margins in FY20. However, with the above-mentioned likelihood of a hike in prices and greater capacity utilisation, the EBITDA margins of domestic newsprint players might record an improvement. Moreover, in the absence of any significant capex plan, cash flows generated through higher realisations will provide support to the credit metrics of domestic newsprint companies.

The newsprint segment’s share in domestic paper production is typically only 7%-8% because of the high imports and marginal growth. Consequently, most newsprint companies have diversified into more lucrative paper segments over the years. Ind-Ra published a report in July 2019, highlighting the trends in the overall domestic and global paper industry.

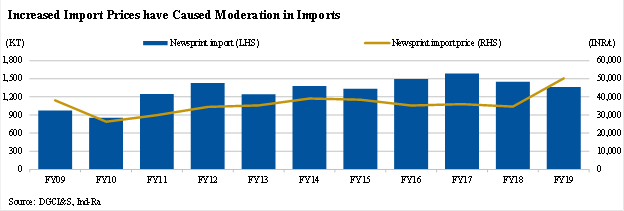

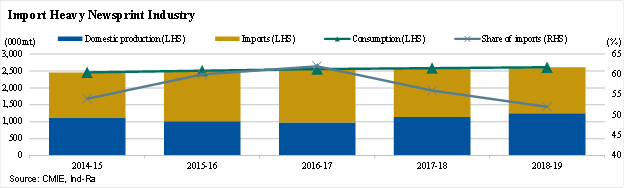

Higher Prices Had Led to Fall in Newsprint Imports in FY19: Domestic newsprint demand increased at only 1% yoy over FY16-FY19 owing to the impact of growing digitisation. Moreover, the industry has been heavily dependent on imports due to the cost-competitiveness of imported newsprint; imports accounted for 52%-62% of the demand during FY13-FY18. In 2018, the Chinese government banned the imports of many varieties of waste paper that are used to produce newsprint. The resultant shortage led to a sharp rise in the prices of imported newsprint. This coupled with rupee depreciation reduced the historical price advantage of imported newsprint, and as a result, its share fell to 52% in FY19 from nearly 63% in FY17. India imported 1.37 million tonnes (mnt) of newsprint in FY19 against a total demand of approximately 2.6mnt.

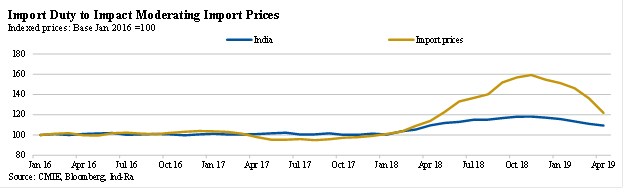

However, since the beginning of 4QFY19, international newsprint prices have declined due to weakened demand and higher supplies, forcing domestic producers to reduce prices. India imported newsprint at an average price of INR43,000/mt in April 2019, down 14% from the FY19 average of INR50,000/mt; domestic players cut prices by 10%-15% over the same period.

The impact of India’s free trade agreements with ASEAN, Korea and Japan is likely to be limited, as these nations account for only around 15% of India’s newsprint imports. Majority of the newsprint is imported from Russia and Canada, with the two countries accounting for around 50% of the imports (FY19: 48%, FY18: 54%, FY17: 46%).

Negative for Print Media Companies: The import duty on newsprint is likely to have an adverse impact on the profitability of print media companies, particularly the English dailies, since they import 70%-80% of the newsprint requirement. In fact, the machines of most of these companies are suited for imported newsprint. Furthermore, the ability of these companies to pass on any increase in newsprint prices is limited; this is evident from the fact that the margins of these companies declined in FY19 when newsprint prices had increased.

Regional newspapers use a higher proportion of domestic newsprint in their mix. However, despite the imposition of import duty, prices of both import and domestic newsprint are likely to dip on a yoy basis in FY20 due to weakened global demand and increased supply. This should provide some relief to print media companies.