In its first Mega Insight study, tech ARC-Unomer today released some key insights about the OTT Entertainment (Live and VOD) App penetration in India. The insights are from UnomerApp Map, an in-depth analysis of smartphone and consumer data collected from over 5 million Smartphone users across the country.

4 out of 5 Smartphone users are having at least one OTT Entertainment platform which they are using for entertainment. This is in addition to the ‘casual’ entertainment over YouTube and other UGC (User Generated Content) platforms like TikTok. With this kind of penetration, OTT Entertainment Apps have become the most penetrated App category among Smartphone users in India, after Social Networking, Chatting and Ecommerce Apps.

Releasing the Mega Insight, Faisal Kawoosa, Founder & Chief Analyst, techARC said, “Over the past 3 years we have seen a lot of enablement both from the Smartphone OEMs as well as operators’ sides. This has facilitated growth of OTT Entertainment services as well as the consumption.”

“While 4G has undoubtedly created this category, it has been adequately complimented by the Smartphone industry by innovating to save every micron on the screen for better and full screen viewing backed by powerful battery and stereophonic sound,” added Faisal, highlighting some of the innovations that have taken place in the recent times keeping increasing video consumption in mind.

Highlighting the OTT Entertainment App trends, Vinay Bapna, CEO and Co-founder, Unomer said, “Video has emerged as a category where we are seeing a large number of players that can co-exist and each player can create a market for itself, unlike other sectors like ecommerce and social media, where there is dominance of 1-2 players.”

Further elaborating, Richa Sood, Director, Unomer said, “Convenience of anytime anywhere entertainment in my favourite genre has sparked the growth of these OTT apps. Gone are the days when consumers had to wait a whole week to watch the next episode. This is driving data consumption and craving for astounding network access and speed.”

Key report insights:

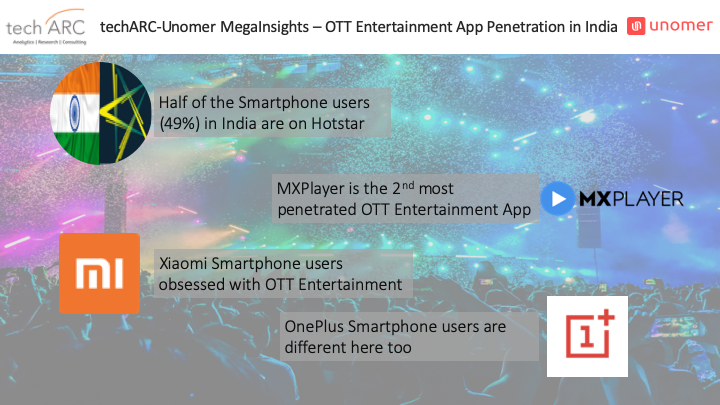

Hotstar leads

Hotstar is the most penetrated OTT Entertainment App with 49% of Smartphone users having it installed on their devices. One of the main factors for Hotstar’s growth has been its sports, especially cricket content, be it IPL or now the World Cup Championship. This is letting people watch their favourite sports entertainment on the go or even catch-up it at their convenience. The app has been able to successfully attain the leadership and continues to retain the top spot.

MX Player is growing fast

After being bought by Times Internet, MX Player was relaunched in February 2019. It has seen since then not only a new aggression but a different positioning of the app and has become among new comers in the OTT Entertainment space. The App has both live TV as well as VOD content. In a very short span of time, it has become the 2nd most penetrated OTT Entertainment app in India, with 42% of the Smartphone users having the app installed on their Smartphones.

Unique users a challenge

While it’s encouraging to have great penetration of OTT Entertainment apps, the challenge still remains with the uniqueness in engagement. 74% of the OTT Entertainment app users have more than one app installed on their Smartphones. This is challenging for the industry as their advertising revenue potential goes down by not owning a higher number of unique users. This is because of similar app available across all major platforms, including in VoD category.

Amazon Prime Video versus Netflix

Amazon Prime Video has a slightly better penetration than Netflix. Prime Video penetration is 15% compared to 13% of Netflix. This is a result of Amazon’s close relationship with some Smartphone OEMs where Amazon apps like Amazon Shopping and Amazon Prime Video come pre-embedded or pre-loaded in the device. However, the delta does not commensurate the tie-ups Amazon has compared to Netflix which doesn’t have any such relationship with a Smartphone OEM.

Jio leads the Live TV

Not only in telecom services, Jio has impacted the OTT Entertainment app space as well. In Live TV category, it leads with 30% penetration among Smartphone users. This is distantly followed by airtel and Vodafone Play.

Xiaomi users obsessed with OTT Entertainment

9 out of 10 (88%) Xiaomi Smartphone users, have an OTT Entertainment app to use. Brands penetration among youth, the main consumers of OTT app is one of the factors behind this high penetration. Also, Xiaomi has launched its Smartphone models allowing users to consume video in a more immersive way with rich display and sound features. Huawei and OPPO are at 2nd and 3rd positions in terms of OTT Entertainment app penetration with 86% and 84% penetration.

OPPO and Vivo overlap here too

OPPO and Vivo have been ‘identical twins’ of the Smartphone industry in terms of positioning and the target. The story is no different in case of OTT Entertainment trend as well. 84% and 83% of OPPO and Vivo Smartphone users have at least one OTT Entertainment app installed. In terms of specific apps, they show very similar patterns. For instance, Hotstar has a penetration of 58% among OPPO users while it is 56% among Vivo users. Similarly, Netflix penetration is 2% among these users. Similarly, these two Smartphone brand users show similar trends in adoption of other apps in this category. There is an opportunity for Netflix to have a special engagement with OPPO and Vivo to popularise their app among these users. OPPO and Vivo are primarily youth centric brands and fall in the Rs 15,000 to 25,000 segment, where users will have a higher propensity to spend on content.

OnePlus has a different pattern

In this segment, OnePlus leads in terms of OTT Entertainment penetration. 78% of OnePlus users have at least 1 OTT Entertainment app on their Smartphones. In contrast to other Smartphone users, where Hotstar leads penetration, Amazon Prime Video has 61% penetration in OnePlus Smartphone users. This is owing to the OnePlus-Amazon strategic tie-up they have over the years. The successful high penetration of Amazon Prime Video app underscores the success of the collaboration and is one of the best collaborations for any app platform. Amazon apps of Shopping and Prime Video are by default pre-embedded with OnePlus devices.

OTT Entertainment apps and Smartphone segments

There is a positive correlation between the price segment of a Smartphone and the penetration of OTT Entertainment apps. In Luxe (>Rs 50,000) and Premium (Rs 25,001-50,000) Smartphone segments, the penetration of at least 1 OTT Entertainment app is 88%, which comes down to 83% in the Mid (Rs 10,001-25,000) segment of Smartphones. In the sub-segment of Rs 10,001-15,000, the penetration is at 79%. This spread pattern is a positive sign for the OTT Entertainment industry as it is getting deployed among users who have the potential to pay as the apps will start exploring more of premium based content to generate revenues, once they go beyond the stage of establishing a user base.

Women are loving global content

79% of the male Smartphone users have an OTT Entertainment app as compared to 74% of females. However, platforms like Amazon Prime Video and Netflix which have a mix of global as well as local content, is more popular among women. The new age women of India are going beyond the regular daily soap operas on the regular TV channels and looking for more engaging and entertaining content for which they watch such OTT platforms. These also include working women and students who are living on their own, typically out of their home city/town. Netflix penetration among women is 9% compared to 8% in men while its 15% and 13% for Amazon Prime Video respectively. The content on such platforms resonates with the struggling and aspirational stories of the rising women power in India.

Jio TV narrowing the Digital Entertainment divide

Broadband technologies are poised to reduce the digital divide. It has started getting reflected in case of OTT Entertainment apps. Jio TV has seen an equal penetration in metros and Tier II/III cities. This has led to balanced adoption of OTT Entertainment across the country. In socio-economically weaker states of Bihar and Jammu & Kashmir, Jio TV has seen over 50% penetration, taking the overall penetration of OTT Entertainment up in such cities and towns. This has led to immense opportunities in vernacular entertainment which is already being focused by some platforms and there are also some smaller amateur players using UGC platforms to ride on the wave.

BSNL is lagging here too

While its known to all that Jio has been the digital frontrunner as an operator of telecom services, its 83% subscribers are on an OTT Entertainment app. This is followed by the incumbents – airtel and Vodafone-Idea at 74%. BSNL is 3rd in the penetration with 66% of its mobile subscribers having an OTT Entertainment app. The OTT Entertainment app growth has seen a direct relationship with the launch of 4G services, which enables user to seamlessly consume such content. Unfortunately, BSNL did not get into 4G services in time as a result of which its presence in OTT Entertainment is weak. This is an important learning for the state-run operator and it must join 5G along with others if it wants to see a healthy growth in 5G driven use cases of data.