Mumbai: Brightcove Inc., the leading global provider of cloud services for video, today published its annual Asia OTT TV market study, The 2019 Asia OTT Research Report, conducted with research partner YouGov, a global public opinion and data company.

The study polled 9,000 participants across nine countries in Asia, including 1,000 consumers in India. The survey was designed to uncover insights into consumer preferences towards OTT services, including subscription tiers and motivators driving subscriptions; how much consumers are willing to pay; their tolerance to advertising and ad-supported subscriptions; and openness to a shoppable TV experience. The report is co-sponsored by Evergent, a leading provider of cloud-based, user lifecycle management solutions for video service providers and SpotX, a leading global video advertising and monetisation platform.

Key findings for India include:

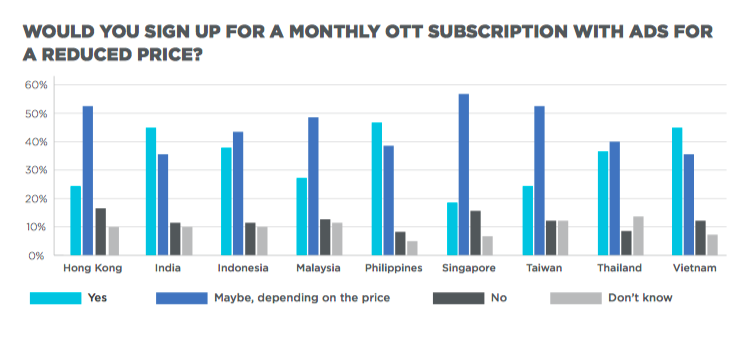

- 35% of respondents said they might be open to a reduced monthly subscription package that serves ads—depending on the price, whereas 44% said they would definitely sign up, representing a potential market size of 79% of respondents polled favouring this hybrid option.

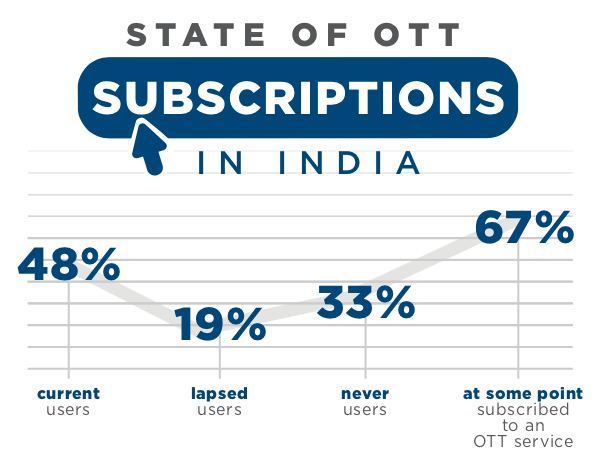

- 60% of ‘Lapsed’ respondents plan to sign-up for OTT services again in the future.

- Subscription fatigue is not common for users in India, as content was the primary driver for their subscription to multiple OTT services. From wanting more content options (42%) and satisfying the content needs for an entire family (42%) to content not being available on any single OTT service (42%), content is clearly the primary driver for subscribing to multiple OTT services in India.

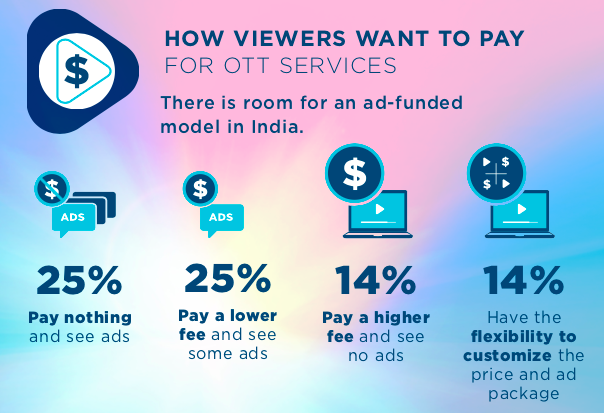

- Thinking about the future, 25% of Indian respondents want to pay nothing and watch ads as a trade-off to consuming content; 25% elected to pay a lower fee with limited ads; 14% would like to pay a higher fee to be free from ads; and 14% would like an option where they can customise their price and ad packages.

- When asked how much respondents would be willing to pay for OTT services, 37% of respondents stated less than USD $1 per month, 27% would pay USD $1-$4 per month, and 16% would pay USD $5-$9 per month.

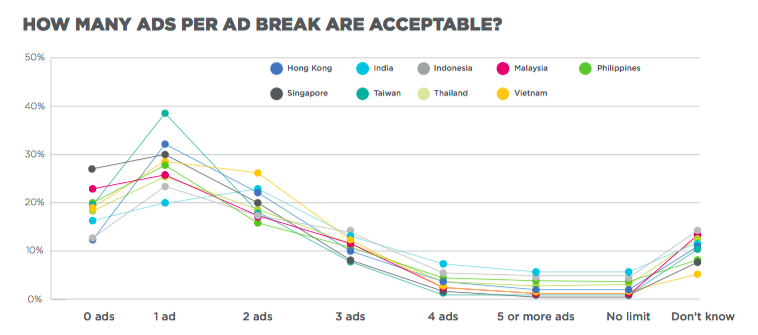

- 22% of Indian respondents found two ads as an acceptable advertising load per ad break and 13% were open to three ads per break.

- Offline downloads (42%), access on mobile (42%), and using less data on mobile (40%) were the top three OTT service features most wanted by Indian consumers.

- When asked if respondents would be open to purchasing product as seen on an OTT program, 67% of respondents were receptive to the idea of shoppable TV.

Janvi Morzaria, Sales Director, India, at Brightcove, said, “Our research findings suggest that the online TV consumer in India sees the value in TV content whether they are paying with greater focus and attention, or with their money. Indian consumers do not mind seeing ads as part of their shows, especially if they are getting a deal. 79% of Indian respondents stated that they are open to a hybrid plan of ad-funded SVOD that comes with a reduced price. OTT service providers should take advantage of this preference and make the advertising experience engaging while limiting ad loads per break. Consumers are now willing to watch ads if they have the option to subscribe to a reduced price plan.”

For years now, most SVOD OTT service providers have set the expectation that consumers will receive zero ads in exchange for a set price to view content. However, the study reveals that revenue from SVOD alone might not be sustainable in the long term. SVOD providers might benefit by experimenting with a mix of packages that offer limited and no ads as an alternative to a traditional subscription plan, allowing users to choose which price plan suits them.

Findings from the 2018 OTT research showed that free trials and promotions were a strong driver for consumers to sign up for OTT services. In 2019, the scenario evolved to the strongest driver being content. Even though there is a willingness to pay for OTT services, price remains a key consideration, along with content. Across the region, Never users are much more price sensitive than Current or Lapsed users.