Mumbai: Industry sources reveal that Astro Malaysia Holdings is in talks to acquire the direct-to-home (DTH) venture of Anil Ambani. Reliance Digital TV has not seen any growth in subscribers base in the recent past and it is being operated without any growth strategy for the past couple of quarters.

According to the source Astro Malaysia is currently carrying out due diligence of Reliance Digital TV, which is part of the listed Reliance Communications, and the valuation of the business is being worked out by the two entities.

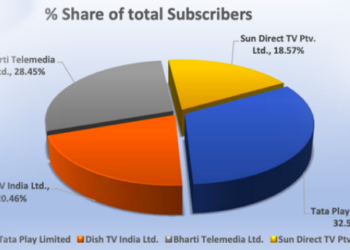

If the transaction works out, it will be Astro’s second investment in the country’s DTH segment after Sun Direct. Astro holds 20% in Sun Direct, a leading pay TV operator in south India. Three years ago, there was speculation about Reliance Digital TV combining with Sun Direct with the former being valued at Rs 1,200 crore. The development is part of Ambani’sstrategy to strengthen the Reliance Communications’ balance sheet.

The Company has debts of around Rs 45,000 crore and it plans to reduce this to Rs 25,000 crorethrough the merger of its wireless business with Aircel and sale of its 51% stake in the tower unit to Canada’s Brookfield. At a media briefing held last week, Ambani had said that to pare RCom’s debt the company would look at selling its other assets including the DTH business.

Astro’s billionaire shareholder T Ananda Krishnan’s Maxis Communications is the largest owner of Aircel, which is in the process of being combined with RCom’s wireless unit. The merged unit, Aircom, will have an equal shareholding between Aircel and RCom.

DTH players in India had just started witnessing some positivity as they started seeing profits in the past couple of quarters. Reliance Digital TV is a minor player in the DTH business with a 2% share of the total active subscriber base.

Recently, Dish TV, owned by Essel Group, and Videocon d2h partnered for an amalgamation that will create one of the largest pay TV operators in the world with over 28 million subscribers.