Mumbai: Cable TV and broadband services provider GTPL Hathway has filed draft papers with markets regulator SEBI to float an initial public offering (IPO).

The public issue comprises fresh issuance of equity shares worth Rs 300 crore and offer for sale of 1.8 crore scrips by the existing shareholders, according to Draft Red Herring Prospectus (DRHP).

Besides, the company is considering a pre-IPO placement of up to 90 lakh equity shares aggregating up to Rs 150 crore to certain investors.

Proceeds from the IPO will be utilised towards repayment of loan and other general corporate purpose. GTPL Hathway is part of the Hathway Cable & Datacom Ltd.

JM Financial Institutional Securities, BNP Paribas, Motilal Oswal Investment Advisors Pvt Ltd and Yes Securities will manage the company’s public issue.

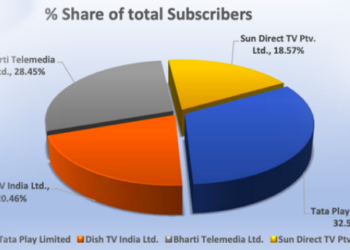

As of September 30, 2016, the company’s digital cable TV services reached 169 towns across India, including towns in Gujarat, West Bengal, Maharashtra, Bihar, Assam, Jharkhand, Madhya Pradesh, Telangana, Rajasthan and Andhra Pradesh. The company has about 5.41 million active digital cable subscribers.