Mumbai: Long term rating on term loans for SITI Cable Network Limited, an Essel Group Company (SITI CABLE) has been upgraded by credit rating agency ICRA. ICRA has upgraded the long-term rating of SITI Cable to [ICRA]A- from [ICRA]BBB+. Further ICRA has a [ICRA]AA(SO)outstanding rating on the term loan facility of SITI Cable. The outlook on the ratings is ‘stable’.

The rating upgrade takes into account the recent equity infusion from the promoter group (Rs. 530 crores in February 2016) and the improving operating performance of SITI Cable, which is expected to result in an improvement in the credit profile of the company. ICRA also noted that being an Essel Group entity, SITI Cable has been benefitting from regular financial support from the promoter group.

Speaking about this rating upgrade, Mr. V D Wadhwa, Executive Director & CEO, SITI Cable mentioned “We welcome this upgrade in SITI Cable’s credit rating and thank ICRA for re-affirming SITI Cable’s growth story. Improvement in profitability, growth in Digital Subscriber base, continuous focus on operational excellence and promoter’s confidence in sustainable growth of the company, have all been the drivers for SITI Cable’s growth. SITI Cable has been at the forefront in offering great value to customers through video and broadband services.”

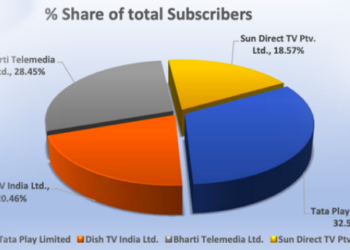

While the transitioning of the cable TV system in India from analog to digital is underway, ICRA reinforced the belief that SITI CABLE’s execution risk is mitigated by the management team’s extensive experience in various areas of the television and media industry. The rating also factors in SITI CABLE’s status as one of the largest multi system operators (MSOs) in India in terms of cable universe (~12.2 million subscribers as of December 2015) and revenues (Rs. 905.9 crore in FY2015) as well as the high growth potential of digital cable services in India.

ICRA has also noted SITI CABLE’s significant investments in consumer premise equipment towards conversion of analog subscribers to digital.

SITI CABLE achieved a financial turn-around for the first time by reporting Profit Before Tax of INR 56 Crores in Q3FY16, the promoters had infused fresh funding in Q3FY16.