The analysts at UnaFinancial, a global fintech holding, surveyed current client experience with digital consumer lending services. With the satisfaction rate of the audience being high, the customers are ready to comprehensively master digital finance.

The current satisfaction of the survey respondents is very high. 87% said they were definitely/likely satisfied with digital lending services. The inclusion of digital finance is on a very high level. Half of the customers already use instant transfers, with nearly half using digital bank accounts. It is a maximum “digital loyalty” that can lead to a greater immersion of financial services.

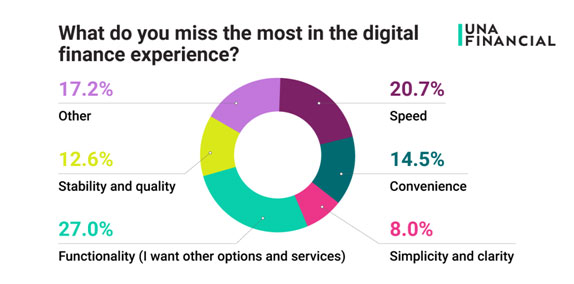

However, the current level of online financial services penetration is not sufficient, according to respondents, and they want to extend their digital financial experience. When choosing the aspects that borrowers are most lacking today, “functionality” topped the list (27%). Other important factors were an increase in speed (21%), convenience (14%), stability and quality of work (13%).

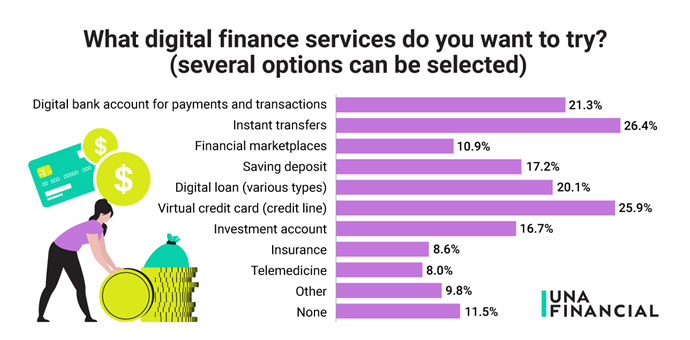

When asked what digital financial services respondents would like to integrate into their lives and use more effectively, 26% identified instant bank transfers and 26% chose virtual credit cards. Almost three-quarters of respondents indicated that they were prepared to fully utilize digital financial services only.

Commenting on the survey results, analysts at UnaFinancial added: “The most commonly selected services from the survey are already included in the digital banking functionality. Notably, between 8% and 11% of the survey respondents said that they want to try all the suggested options – investments, telemedicine, insurance, etc. The large number of respondents interested in online financial services can be viewed as an indicator of customers’ willingness to move to digital proficiency. Digital banking has a strong presence in the Philippine market, but is still in its infancy. It can indeed grow rapidly and attract even more consumers in the near future, which is proven by users who adopt a more holistic approach to their personal finances.”

Respondents to the survey are digital consumer lending users in the Philippines. The detailed data comes from an e-mail survey that involved 174 people.