Mumbai: GroupM, WPP’s media investment group in India, has unveiled its latest report, Profiling Cinemagoers, offering deep insights into cinema viewing habits across five major metropolitan cities—Bengaluru, Delhi, Pune, Mumbai, and Hyderabad. Conducted with a representative sample of 1,075 individuals aged 18-44, the study provides a comprehensive analysis of audience segmentation and its impact on consumer behavior.

Cinema Viewership Trends & Advertising Impact

The report categorizes audiences into three segments:

- Heavy Viewers (4+ movies per month) – 23% of respondents, the most engaged segment.

- Medium Viewers (2-3 movies per month) – 57%, the largest share of cinema-goers.

- Light Viewers (1 movie per month) – 20%, showcasing selective but consistent engagement.

On average, Indians watch 18 movies per year, with male audiences outpacing female viewers. 42% of moviegoers watch films on the release day, while 25% prefer first-day, first-show screenings. Evening screenings remain the most popular, and 75% of audiences watch movies with family or friends, reinforcing cinema’s role as a social experience.

The findings emphasize cinema’s value as an advertising platform, with 42% of respondents stating that on-screen advertisements influence their purchase decisions. Powered by ProCAT, GroupM’s web-based audience analytics platform, the study provides data-driven insights for brands and advertisers to execute targeted campaigns effectively.

“Cinema is not just an entertainment medium; it’s a powerful avenue for brand engagement,” said Ajay Mehta, Managing Director – Cinema, OOH, and Experiential Marketing, GroupM India. “With 42% of viewers acknowledging cinema ads’ impact on purchase decisions, advertisers have an opportunity to create immersive and meaningful campaigns.”

Siddharth Bhardwaj, CEO of UFO Moviez India, highlighted cinema’s role in the ‘out-of-home economy,’ citing ₹12.38 billion in Gross Box Office Collections (GBOC) and 858 million footfalls. UFO’s ProCAT platform enables brands to leverage historical data, guaranteed footfalls, and predictive insights to enhance advertising effectiveness.

2024 Cinema Industry Trends & Regional Performance

Despite the absence of superstar-led blockbusters like Pathaan and Jawan, the Indian cinema industry remained robust in 2024, driven by content-led successes:

- South Indian Films Dominate – Pushpa 2 and Kalki achieved higher collections in Hindi-speaking markets than in their original languages. Pushpa 2 led the box office with ₹12.69B GBOC and 65M footfalls.

- Regional Hits Shine – Films like Hanuman (Telugu) and Amaran (Tamil) grossed over ₹300 crore each, reinforcing the rise of regional cinema.

- Strong Market Performance – Bengaluru led box office revenues with ₹28.6B and 45M footfalls, followed by Hyderabad and Chennai. Kerala saw a 20% growth in collections due to content-driven successes like Manjummel Boyz and Avesham.

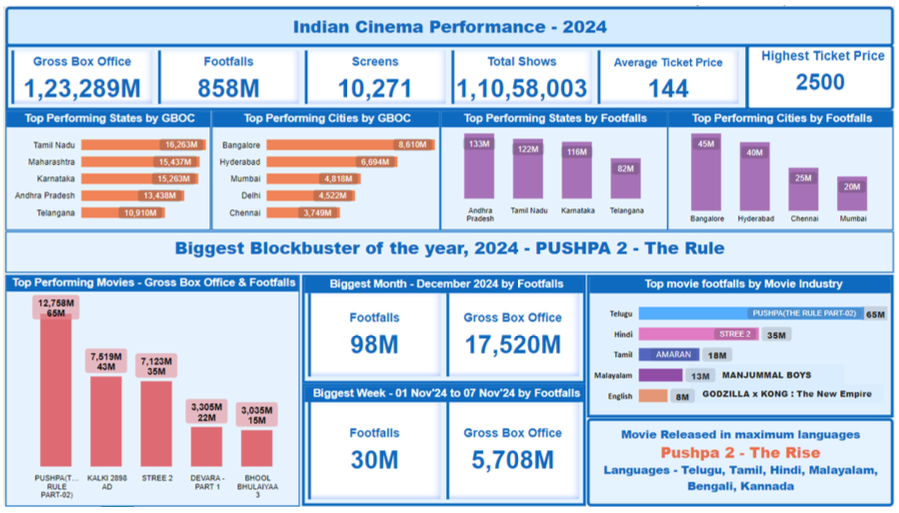

Industry Performance Metrics (2024)

- Gross Box Office Collection: ₹123B

- Total Footfalls: 857M

- Total Screens: 10,271

- Average Ticket Price: ₹145

- Month with Highest Footfall: December 2024 (97M footfalls, ₹1,746 Cr BO)

Record-Breaking Highlights

- Pushpa 2 (Telugu) had a historic ₹7.5B opening week, with 34.3M footfalls across multiple language versions.

- December 2024 recorded 2.14B total viewing hours, the highest for any month.

- The most expensive ticket price hit ₹2,500, indicating audience willingness to pay a premium for high-demand films.

As India’s cinema landscape evolves, data-driven insights from Profiling Cinemagoers reinforce the growing relevance of theatrical entertainment and its potential as a high-impact advertising channel. With cinema continuing to thrive as a key pillar of India’s entertainment industry, brands have a unique opportunity to engage audiences in an immersive and high-attention environment.