Axis My India, a consumer data intelligence company, released its latest findings of the India Consumer Sentiment Index (CSI), a monthly analysis of consumer perception on a wide range of issues.

The report highlights that media consumption has increased for 20pc of those surveyed. TV is still the medium where brand advertising is noticed the most closely followed by digital. It further emphasises the significance of 5G and enhanced telecom connectivity for speeding up India’s digitization. The pre-budget report highlighted that reduction in price of essentials is the biggest expectation from the 2023 budget. One of the major requests which comes out in this survey is reduction in income tax rates, which will give consumers more money in hand.

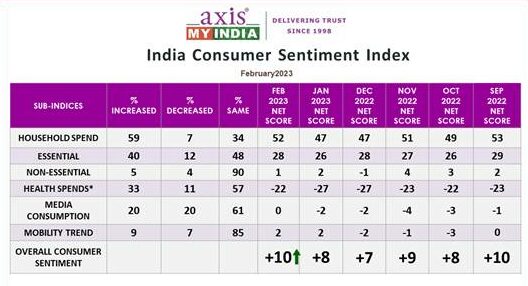

The sentiment analysis delves into five relevant sub-indices – Overall household spending, spending on essential and non-essential items, spending on healthcare, media consumption habits, entertainment & tourism trends.

The survey was carried out via Computer-Aided Telephonic Interviews with a sample size of 6100 people across 27 states and UTs. 65pc belonged to rural India, while 35pc belonged to urban counterparts. In terms of regional spread, 23pc belong to the Northern parts while 27pc belong to the Eastern parts of India. Moreover, 28pc and 22pc belonged to Western and Southern parts of India respectively. 69pc of the respondents were male, while 31pc were female. In terms of the two majority sample groups, 33pc reflect the age group 36YO to 50YO and 30pc reflect the age group of 26YO to 35YO.

Commenting on the CSI report, Pradeep Gupta, Chairman & MD, Axis My India, said “Consumers are looking forward to various measures taken by the government towards fuelling a digital India. As per 22pc of those surveyed, penetration of ‘all things digital’ (better digital banking, better internet security, 5G) is important for Indian economy. This is because more and more people are adopting the digital way of life. The gap between ads noticed in digital over television is also reducing even though TV continues its dominance when it comes to advertising recall. It is thus important for marketers to take note of the respective strengths of the new vs old forms of advertising while designing their overall media mix.”

According to a pre-budget survey by Axis My India, 38pc of those surveyed noticed brand advertisements on TV, while 32pc noticed ads on digital media. Of those surveyed, 51pc have noticed advertisements at least once or more on digital media.

The survey also shed light on factors that could aid digitization in the Indian economy, with better banking network (32pc), improved telecom connectivity and 5G (19pc), and better internet security (18pc) considered key elements. The survey attempted to gauge citizens’ sentiments towards the Indian economy and found that 22pc believe oil prices will significantly impact the Indian economy this year, while 16pc each believe inflation and the 2024 elections will also have an impact. 14pc are concerned about government policies, and 11pc are concerned about the Russia-Ukraine war.

When it comes to consumer expectations from the budget, the survey revealed that a majority of 73pc want the budget to address the reduction in prices of essential items, such as soap, detergent, and cooking oil. 54pc believe the budget should consider GST exemptions on essential items, 44pc want a reduction in the GST percentage, and 32pc want a re-evaluation of housing loan exemptions. The survey also indicated that 26pc believe the Finance Minister should lower personal income tax rates by 5pc in the upcoming budget, while 25pc want the exemption limit to be raised beyond 2.5 lacs.

Key CSI findings:

- Consumption of media (TV, Internet, Radio etc.) has increased for 20% of the families, which reflects a decrease by 1% from last four months where it has been consistent at 21%. The overall, net score, which was at -2 last month, reflects 0 this month.

- Mobility has increased for 9% of the families, which reflects an increase by 2% from last month. The overall mobility net indicator score, which was at +2 last month, has remained the same this month.

- Overall household spending has increased for 59% of families, increased by 4% compared to last month. The net score, which was +47, last month has increased by 5 to +52 this month.

- Spends on essentials like personal care & household items has increased for 40% of the families, which reflects a dip by 1% from last month. The net score, which was at +26 last month, increased by two at +28 this month.

- Spends on non-essential & discretionary products like AC, Car, and Refrigerator has increased for 5% of families, which reflects a decrease by 2% from last month. The net score, which was at +2 last month, has reduced to +1 this month. Sentiment towards discretionary spends highlight the lowest percentage increase in the last four months.

- Expenses towards health-related items such as vitamins, tests, healthy food has surged for 33% of the families. This reflects a decrease in consumption by 6% from last month. The health score which has a negative connotation i.e., the lesser the spends on health items the better the sentiments, had a net score value of -28 last month, is at -22 this month. Sentiment towards health spends also showcase the lowest percentage increase in the last four months.