Digital platforms are growing ever-more influential and marketers are increasingly tasked with building their brands within ecosystems over which they have little or no control.

Building brands in the ‘walled gardens’ is the main theme highlighted in the Industry chapter of WARC’s Marketer’s Toolkit 2020 an annual report that assesses the influences on marketing strategies for the year ahead.

David Tiltman, VP Content, WARC, comments: “For the Industry chapter, we’ve taken a close look at the drivers dictating the competitive environment.

“Customer experience (CX) will remain a priority for marketers’ time and investment and will continue to drive the digital transformation agenda, and in-housing of adtech will continue as brands take charge of their data. However, we see the major story for next year being the growing reliance of advertisers on ‘walled gardens’, the digital platforms that combine paid advertising and payment tech or e-commerce fulfilment.”

Walled gardens combine advertising with payment

Amazon is chipping away at Google’s supremacy of the search advertising market and is projected to earn $13.9bn from advertising in 2019. Advertising accounts for a fifth of Tencent’s global revenues, worth over $8bn, while Alibaba and JD.com dominate the retail landscape in Asia, with combined annual revenues of nearly $450bn.

These ‘walled gardens’ increasingly combine paid advertising with payment and e-commerce fulfilment, with the promise to marketers of much more visible links between marketing investment and sales performance. However, as those platforms grow ever-more influential, marketers are increasingly tasked with building their brands within ecosystems over which they have little or no control.

Xian Wang, Global Content Director, Edge by Ascential, notes: “Digital ecosystems become the primary place to engage with consumers… The reach of digital marketplaces offers convenient comparisons for shoppers meaning suppliers will have an increasingly difficult time differentiating from the high volume of other vendors.”

35% of total respondents and 23% of brand respondents to WARC’s Toolkit survey said they plan to increase advertising spend with Amazon in 2020.

Facebook moves into payment as retailers move into media

Ease of payment is a key pillar to platforms’ success. The mass adoption of apps such as Alibaba’s Alipay and Tencent’s WeChat Pay in China has inspired Facebook’s attempts to launch a cryptocurrency, the Libra Association, and accompanying digital wallet, Calibra.

Sanjib Kalita, Editor-in-Chief, Money 20/20, says: “Digital platforms have redefined convenience. By eliminating the time between item selection and payment, digital platforms have maximised the opportunity for impulse purchases.”

While digital companies possess rich user data, including all-important signals of intent from previous search behaviour, physical retailers have an additional advantage in the form of in-store purchase insights and are now copying platform business models.

Jill Baskin, Chief Marketing Officer, The Hershey Company, says: “The bigger ecosystem coming online is that retailers [like Walmart and Target] are starting to sell media. They’ll have closed ecosystems, so we should be able to see immediately who’s buying, what they’re buying and whether it’s working. That could be huge if it works.”

Amazon is focused on winning brand advertising dollars in 2020

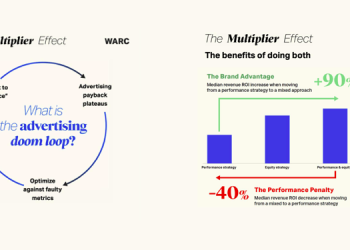

Most spend on Amazon is currently linked to performance outcomes. But, as Amazon sets its sights on the brand dollars still being spent on TV media, the platform must decide the extent of compromising user experience to allow brands to engage consumers in more immersive and potentially less efficient ways.

20% of respondents (up from 17% last year) cite the dominance of Google/Facebook/Amazon as the biggest cause for concern when drawing up marketing plans for 2020.

WARC’s Marketer’s Toolkit 2020, the definitive, evidenced-based and practical guide for marketers to plan for 2020, is based on a survey of almost 800 client and agency-side practitioners around the world, combined with insight from a series of interviews with Chief Marketing Officers, backed by evidence from WARC Data, case studies and expert opinion.